Why is the threshold for joining Haidilao so high?

[ad_1]

To do a new thing that doesn’t look so “Haidilao”, you need to consider all risks in advance.

On March 4, Haidilao, China’s largest hotpot chain company, posted a QR code to apply for franchise on its official website to openly recruit franchisees. At this time, China’s catering market is setting off an unprecedented “franchise wave”. It is surprising that Haidilao, which has maintained a direct operation model for 30 years and is doing well, joins the fray.

Zhou Zhaocheng, vice chairman of Haidilao’s board of directors, recently mentioned in an exclusive interview with Caijing that “thousands” of applications had been received in less than January after the application channel was opened. Haidilao is currently undergoing the first round of screening, and a very small number of people have applied. Passed the preliminary screening.

This looks more like a high-end game – in addition to the rigid condition that “the minimum capital threshold for applicants is 10 million yuan”, Zhou Zhaocheng mentioned that Haidilao also has many “hidden” assessment thresholds for entrants: Only institutional investors and experienced companies are accepted, and ordinary investors or the general public are not accepted to avoid people who want to make a desperate move by joining Haidilao; they need to be consistent with Haidilao’s values. For example, if an old man falls, even if there is a risk of being blackmailed, You have to help, don’t stop doing what you should do because you are worried about the risks; don’t join for huge profits, etc.

According to the established strategic plan, joining the franchise will not change the current strategic rhythm of Haidilao in the short term. Zhou Zhaocheng revealed that the proportion of franchise stores will be very small. Based on Haidilao’s current 1,374 stores, a maximum of 100 franchise stores can be opened. In the current wave of franchising companies that are clamoring for “thousands of stores”, Haidilao’s planning seems to be quite cautious. “We haven’t set a goal. How many franchise stores we want to have in a few years is just a test of the water.” Zhou Zhaocheng even envisioned the risks of the future franchise model: the fully managed model is currently just a sandbox deduction, and there will be changes in the process. Won’t new problems arise unexpectedly? “There will definitely be. We need to do it cautiously and steadily, and then we will see if the franchise can truly replicate and develop. If possible, make adjustments.”

Is the market overestimating the incremental role of high-end franchise bureaus in Haidilao, or does Haidilao have other plans? In the franchising trend that relies on speed and points to win, why does Haidilao insist on the “high threshold, low expectations” strategy? In what new competitive dimension will this wave of franchising bring the entire catering industry? What are you arguing about? In a rapidly changing market, what is Haidilao’s backup plan? Zhou Zhaocheng answered some questions to Caijing. There are still some questions that can only be left to time.

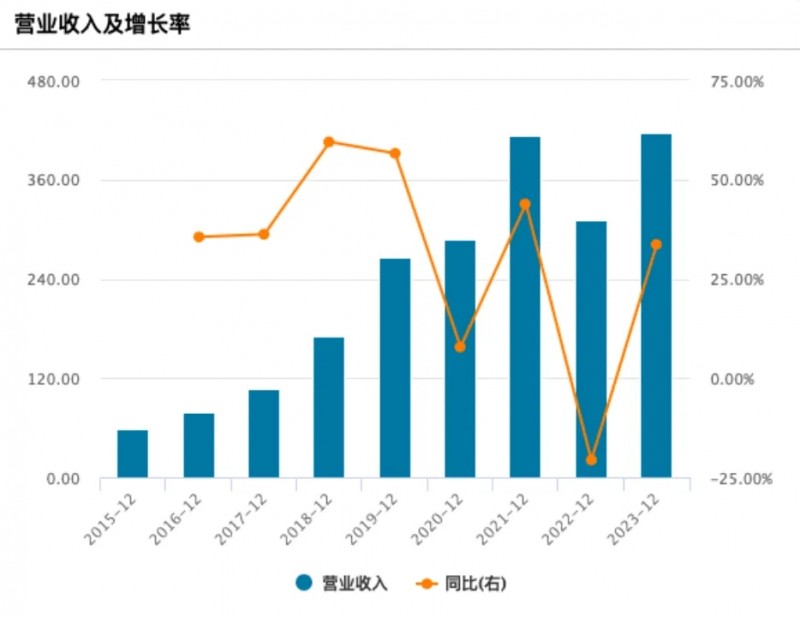

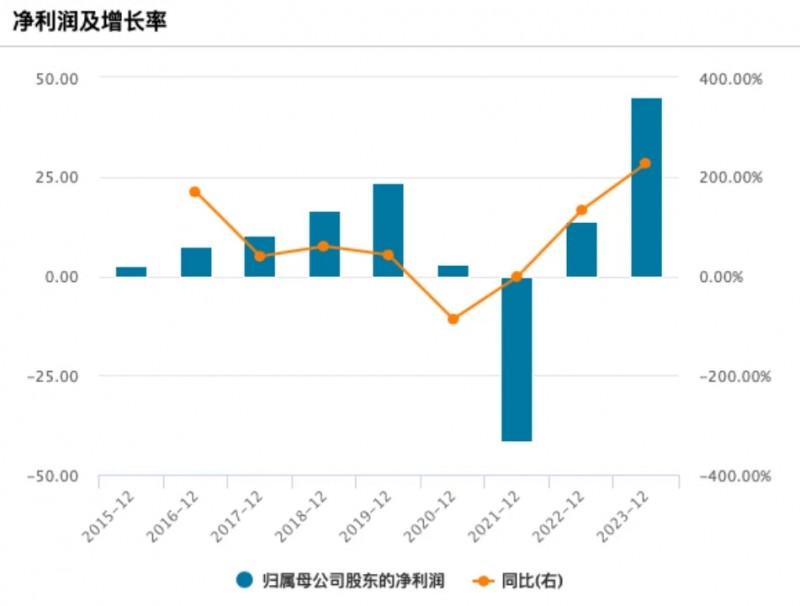

At this time, Haidilao is at a delicate moment. On the evening of March 26, Haidilao released its 2023 annual performance report. The data showed that Haidilao’s revenue and net profit both hit new highs in 2023. Revenue rose 33.6% to 41.453 billion yuan, especially net profit soared 174.6% to 4.495 billion yuan, the profitability has gone out of the low point of losses three years ago.

The table turnover rate and the unit price per customer have shown opposite trends. The overall table turnover rate has increased from 3.0 times/day in 2022 to 3.8 times/day in 2023, but the unit price per customer has dropped from 104.9 yuan to 99.1 yuan. In other words, more people go to Haidilao to dine, but each person spends less money.

As of December 31, 2023, the number of Haidilao stores was 1,374, a net increase of only 3 stores compared with 2022, and a decrease of 8 stores compared with the first half of 2023. The lack of store expansion may be one of the important driving forces behind Haidilao’s decision to open up franchises. After the results were announced, Haidilao’s share price fell 0.94% on March 27 to close at HK$16.86, with a total market value of HK$93.98 billion.

Changes in Haidilao’s revenue and net profit Unit: 100 million yuan.

1. Why should the threshold be raised?

If you want to become a Haidilao franchisee, you need to go through three rounds of screening and a round of training before formal cooperation, which is comparable to “passing five levels to defeat six generals.”

It has been more than half a month since Haidilao posted the QR code for joining the franchise on its official website on March 4. Haidilao received “thousands” of franchise applications, but many failed to pass the first round of screening.

Zhou Zhaocheng introduced that the first round of screening is some basic information, including the amount of funds that can be invested, the expected return period, personal income in the last year, personal total assets, highest academic qualifications, catering or other business experience, whether there are property resources, etc. There are a dozen questions in total. The lowest level of “amount of funds that can be invested in Haidilao business” and “total personal assets” is “less than 10 million yuan”, and the higher levels are 20 million yuan, 50 million yuan, and the highest level is “more than 100 million yuan.” It can be seen that if you want to join Haidilao, you must have sufficient financial strength.

“Our selection of franchisees this time is limited to institutional investors and experienced companies, and we do not accept individual investors.” Zhou Zhaocheng said bluntly.

Institutional investors include but are not limited to investment funds; enterprises refer to some experienced business entities. Zhou Zhaocheng’s standards have some reference – it is better to have catering experience, but it is not necessary to have done catering, as long as the institution and enterprise You are not a “newbie” and you have some understanding of the cyclical changes in the economy and its complexity.

A few people have passed the initial screening and are waiting for the second round of review, and will receive a second response within 30 working days. If you pass the second round, there will be a third round, and the applicant needs to pass Haidilao’s “Join Review Committee”. This is an organization specially established by Haidilao for the franchise business. Both parties need to communicate face-to-face, focusing on some issues of values and concepts. The two parties can feel the incompatibility of the atmosphere and whether the franchisees understand and agree with Haidilao’s values and management methods.

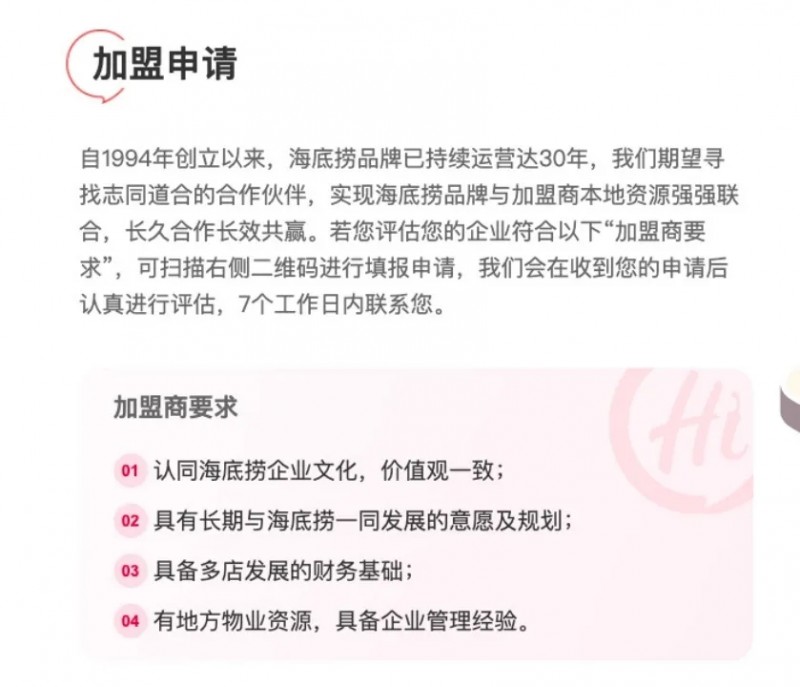

Haidilao has written a total of four requirements for franchisees. The first one is to “identify Haidilao’s corporate culture and have consistent values.” Zhou Zhaocheng said: “I think the media has less discussion on this point. In fact, this is not a pragmatic requirement, because we are a company with strong cultural genes.”

Haidilao franchise requirements Source: Haidilao official website

Zhou Zhaocheng believes that cultural recognition is very important. “It is precisely because of strong culture that Haidilao can have its own characteristics. It is even considered that its essential product is a service, and hot pot is just a carrier.”

But how to judge whether franchisees agree with the corporate culture?

Haidilao has set up an “entry physical examination” link. Franchisees who have passed three rounds of screening need to undergo a round of corporate culture training when they formally sign a contract for cooperation. Training is handled by Haidilao’s “Learning and Development Center”, which was also known as Haidilao University in the past.

There is no charge or exam for this round of training, but many past management cases and corporate culture cases of Haidilao will be introduced to franchisees during the training. During this process, it will be more obvious whether the franchisees agree or not. In other words, if you don’t agree with it, you are not willing to waste time and money and quit as soon as possible.

Zhou Zhaocheng gave two examples. One example is that after the Peng Yu case in 2006, there was a voice in the society that “old people are afraid to help when they fall.” Zhang Yong, chairman of Haidilao, made it clear that Haidilao employees should not hesitate to respond if they encounter this kind of situation. Go and help. If you are touched, the company will take care of it.

In addition, Haidilao’s store assessment design focuses on customer satisfaction and employee satisfaction. Only when these two ratings are high will the store manager be promoted and receive incentives; financial indicators such as revenue and profit are secondary. This set of standards will also be copied to franchise stores.

Zhou Zhaocheng revealed that if the franchisee listened to the first case and said, “You are too stupid, why do you care so much about social affairs?” and listened to the second case and said, “I joined to make money and only look at the results.” Then these are not the people Haidilao wants.

He told Caijing that for franchising, Haidilao sets standards based on its own actual situation. It does not pursue speed or quantity, but pursues quality and stability. Therefore, the limited targets are institutions and experienced companies, not ordinary investors or the public. Because relatively speaking, their understanding of industry cycles, corporate culture and corporate values is empathetic and deeply experienced.

“The idea of individual investors is that if I invest in you, you have to let me make money. But investment has risks, and sometimes you have to be willing to admit defeat.” He said that individual investors have weak ability to resist risks, while experienced companies follow the institutional investment People are sober in this regard.

In the franchising trend that relies on speed and points to win, many brands are competing for franchisees, gradually turning into a “buyer’s market” for franchisees. Haidilao’s requirement for high recognition of funds and values can be said to be a “High threshold” strategy.

Shen Meng, director of Chanson Capital, commented to Caijing that for Haidilao, a high-threshold strategy can make the franchise stable. “Some people say that Haidilao is harvesting wealthy investors. This is too narrow a perspective. It has already been listed, and there is no need to lower the threshold for joining in order to grow in scale.” He said that setting a high threshold can screen out high-quality Investors also ensure that the franchise process is controllable.

“Only Haidilao would make such a request, which is rare in the entire catering market.” Chen Jianrong, president of Weijie Catering Group, said in an interview with Caijing, “On the road to franchising, it (Haidilao) is the most There is no such thing as a loud sign.” He said that more and more brands are opening up for franchising, and franchisees have a lot of room for choice, gradually moving towards a “buyer’s market,” but in Haidilao it is still a “seller’s market.”

Chen Jianrong’s friends in the same industry applied to join Haidilao, but none of them passed the preliminary screening and did not even receive a call.

2. Why can’t you make “huge profits” by joining Haidilao?

Zhou Zhaocheng emphasized that Haidilao’s “ideal type” is not here to make quick money. But efforts will be made to allow franchisees to obtain a “reasonable” return on investment.

He did not disclose the franchise details in the interview, such as how much the franchise fee is and how the interests of the franchisee and the headquarters will be divided. He said that this involves “commercial secrets” and is “discussed on a per-store basis.”

However, a certain principle is that Haidilao will adopt a “full trusteeship” model and adopt Haidilao’s business model, assessment, and supply chain. The labor relationship of store employees belongs to the franchisee, but the training of employees is done by Haidilao, and the store manager is also dispatched by the headquarters.

According to him, franchisees are more like LPs (limited partners, generally referring to people who provide funds for equity investments) and become partners of Haidilao through joining.

Therefore, joining Haidilao is not an entrepreneurial act. On the one hand, some entrepreneurial novices may not have a deep understanding of the risks of franchising. On the other hand, some entrepreneurs give themselves room for trial and error, saying, “At worst, if this store doesn’t do well, it will be lost. But for us, if If this store doesn’t do well, it will actually hurt our brand.” He said that in fact, Haidilao is more concerned about whether the franchise store can run well than the franchisees.

Zhou Zhaocheng’s attitude is clear, franchisees can only obtain an investment income that is in line with the laws of market development. He said that joining Haidilao cannot make “huge profits.” “The profit margin of the catering industry is not that high. Our net profit is about 10%, which is pretty good compared with some industries.”

But if the franchisee really “loses” and the loss is tens of millions of dollars, how can Haidilao ensure the safety of the franchisee? Zhou Zhaocheng responded that the management, rating, and elimination of franchise stores will be the same as those of existing directly-operated stores. Evaluating the store investment return cycle, evaluating store management capabilities, and providing guidance and improvement to lagging stores are all consistent with the store assessment principles that Haidilao has adhered to for many years. If you encounter business difficulties, you also need to analyze the internal and external causes based on the actual situation before making a diagnosis and prescribing the right medicine.

A research report from Soochow Securities shows that the investment in a single Haidilao restaurant is about 8 million to 10 million yuan. According to the 2023 results announced by Haidilao, based on the same store (restaurants operating for more than 300 days in 2022 and 2023), the overall same store turnover is 29.3 billion yuan, and there are 950 comparable restaurants. In this category, a single store The turnover was 30.87 million yuan. If calculated based on a net profit rate of 10%, the net profit of a single store is 3.087 million yuan. Based on this calculation, the payback cycle for a single Haidilao store is between 31 and 39 months, which is about three years.

Wen Zhihong, general manager of catering chain expert Hehong Consulting, told Caijing that the current overall capital required to join a hot pot restaurant is usually on the order of 2 million to 3 million yuan, and the threshold for Haidilao is relatively high. On the platform of the catering service provider Zhaimen, the four hot pot brands Xixike, Zhao Meili, Bazhuang and Luzhang, which have more than 150 stores, have invested between 1 million and 2.2 million yuan in opening stores.

Requirements for joining four hot pot brands Source/Zhaimen

“It is not difficult to find candidates who are suitable for Haidilao.” Wen Zhihong said that such a large project of 8 million to 10 million yuan is similar to investing in an economic hotel. If Haidilao stores can pay back their capital in about three years, it will be relatively is attractive.

As for whether franchise stores can achieve Haidilao’s average net profit rate of 10%, Wen Zhihong analyzed that this is related to the franchise mechanism, including how much management fees and supply chain fees the headquarters charges, and how the interests of the headquarters and franchisees are distributed.

According to the “Commercial Franchise Management Regulations”, the franchisor (brand owner) shall not engage in deceptive or misleading behavior during promotion and publicity activities, and shall not promote earnings in advertisements.

Therefore, many brands will not publicly talk about the return on investment and payback cycle. However, for example, the franchise model in the hotel industry has been around for a long time. Even if the brand does not announce it, third-party service providers will make data models for franchisees to see. However, Haidilao’s franchise has just started and there is no relevant information yet.

Another opinion from the market is the opposite. A tea franchisee commented that it is not easy for Haidilao to find a truly suitable franchisee. The capital requirements for Haidilao to join are too high, and capital verification requires 20 million yuan. Such a threshold has blocked many people from the door and is not an option for him.

The above-mentioned tea drink franchisee told Caijing that he met Haidilao’s capital threshold requirements. But he is more willing to invest in tea beverage projects because the payback cycle is short. He established a company and joined many well-known coffee and milk tea brands such as Luckin, Bawang Tea Ji, and Lele Tea in East China, with a total of 20 stores. Depending on the brand, the franchise fee ranges from 700,000 to 1.5 million yuan, which means that he and his team have invested 20 million yuan in 20 tea shops.

Some of these tea drinking projects have achieved return on investment in five months, and the longest return on investment has been one year. Since the investment scale of the tea shop is small, he can open new ones while repaying the capital, and at the same time recruit some partners to speed up the opening of the shop, and the rolling efficiency of funds will be higher.

Although Chen Jianrong is concerned about Haidilao’s franchise issues, he also bluntly stated that he will not apply for it at the moment. “We haven’t reached the stage of retirement yet. If we want to provide for retirement in the future, we should also try Haidilao and invest in it and let them manage it. Now that we are young and strong, we should do our own innovation and our own brand.”

3. Be cautious or play it safe

Haidilao has always been known for its meticulous service and has invested heavily in employee management and labor costs. Unifying and standardizing the services of thousands of stores is not an easy task in itself. Therefore, it has always been considered more suitable for expansion through direct operation, and has never been open to franchises before.

After insisting on direct operation for 30 years, why did it suddenly open to franchise?

Zhou Zhaocheng said that direct operation or franchising is a choice of business models at different times, and there is no good or bad distinction. “Haidilao has always been a direct operation model for the past 30 years, which has brought benefits to the development of the company, but it does not mean that we have to stick to one model all the time.”

The advantage of joining is that the headquarters and external resources form a synergy. For example, if some franchisees bring their own high-quality property resources and are more familiar with the local market than the brand headquarters, then the “1+1?2” effect will be achieved.

Haidilao has now decided to open up franchising because three conditions have matured: mature store operation management and incentive system, strong supply chain capabilities, and the market soil for franchising has gradually matured.

The first two conditions can be said to have been relatively mature when Haidilao went public in 2018. The real variable is the third one – market soil.

In the past two years, it has been a trend for well-known chain companies in the catering industry to abandon the full direct operation model and open up franchises. A number of coffee and tea brands including Luckin, Heytea, Naixue, and Kudi will open franchises one after another from 2021 to 2023. By 2024, Shenzhen’s Le Caesar Pizza will be launched in January, and Jiumaojiu, the parent company of Taier Pickled Fish, will be launched one after another in February.

“The market environment and perceptions of franchisees are completely different between franchising 10 years ago and franchising now,” Zhou Zhaocheng commented. In the 30 years since its establishment, Haidilao has been observing and discussing the franchise model internally, and has also been asked by the outside world. This time it will actually start in the second half of 2023.

It is understood that the franchise business is currently in charge of an “old Haidilao person”. She once served as the rotating chief operating officer of Haidilao and currently serves as the regional manager and is also responsible for the franchise business.

Soochow Securities analyzed that through the asset-light franchise business model, Haidilao can pass on part of its operating costs, improve its ability to resist risks and optimize the quality of its statements. It is expected that Haidilao will take a commission from store revenue as its main profit method, and the addition of new franchise stores is expected to increase its overall performance.

At present, Haidilao has expressed an extremely cautious attitude towards franchise expansion. Yum China is the Chinese catering company whose current market value exceeds that of Haidilao and ranks first in the Hong Kong stock market. KFC announced an expansion plan in September 2023 – franchise stores will account for 15% to 20% in the next three years.

In this regard, Zhou Zhaocheng said: “The proportion of Haidilao franchise stores will be very small.”

“We have not set a goal of how many franchise stores we will have in a few years. We are just testing the waters.” He said frankly, “The full hosting model is just a sandbox deduction. It is unexpected whether new problems will arise in the process. ? There will definitely be. Therefore, we must do it cautiously and steadily, and then see whether the franchise can truly be replicated and developed. If possible, we will adjust the plan.”

Zhou Zhaocheng believes that due to the fully managed model and this “slow pace”, Haidilao can promise that its service quality and product standards will remain consistent in both direct-operated stores and franchise stores and will not go downhill. On the other hand, too many franchise stores will not affect the interests of franchisees, because franchisees do not have the right to choose locations to open stores at will, and all decision-making rights rest with Haidilao.

“Full management is a strange thing in the catering industry.” Chen Jianrong said, “So many hot pot restaurant franchises are trained by the headquarters and let them run their own operations. None of the milk tea shops are fully managed and require franchises. The dealer must go to the store, that is, look after the store full-time. As a brand owner who can be fully managed, the strength itself is very strong. “

The essence of full trusteeship is direct management, which is rare in the catering industry. Because there are many self-employed catering businesses, self-employed businesses do not need to issue tax invoices. The husband-and-wife team also saves part of the labor cost. The self-management of franchise stores is more profitable than the direct operation of the headquarters. Only big brands like Miniso and Heilan Home adopt the full custody model when opening large stores. Because of the brand premium, high single store turnover, and large profit margins, they can afford full custody.

The owner of a small restaurant believes that (full trusteeship) means that franchisees bring capital into the group and only have the right to invest, not even the right to criticize.

But from Haidilao’s perspective, strong control over business decisions is also a protection for franchisees. Zhou Zhaocheng believes that franchising is a business, and any business has risks. Even powerful brands such as Haidilao are facing challenges during the epidemic. What Haidilao can do is to take care of the interests of franchisees and do its best to achieve a win-win situation when introducing the franchise business model.

While many coffee, tea, and catering businesses are relying on franchises to reach the “10,000-store” scale, Haidilao is still at the “1,000-store” level. Regarding this point, Zhou Zhaocheng made it clear that milk tea shops and Haidilao stores are different in scale. “Ten thousand stores” is not the goal, but Haidilao’s market value and revenue exceed those of some “ten thousand stores” companies.

Zhou Zhaocheng denied that Haidilao told stories to the capital market through franchising. The current market value of Haidilao is about HK$93 billion. Since the announcement of the opening of franchises, the market value has increased by nearly HK$20 billion. However, compared with the market value of HK$470 billion at its peak in February 2021, it is still at the bottom of the mountain.

“There is no such consideration at all (raising the stock price through franchising). If we consider this, all actions will be distorted.” Zhou Zhaocheng said, “If we want to cater to the preferences of the capital market, then we should immediately say that we will join the franchise and open thousands of stores. The capital market has gone crazy. But we have never used the reaction of the capital market to guide business operations.”

“It is difficult to control the laws of the capital market, so we should focus on our own development.” He said.

4. Franchise, export of catering companies

Haidilao has just emerged from the self-correction of losses and store closures during the epidemic, with revenue and net profit hitting new highs. However, it still has not recovered its strength in terms of store expansion.

Before and after the epidemic, due to early strategic misjudgments and rapid expansion, Haidilao once took the initiative to launch a store closure operation. In November 2021, Haidilao announced the “Woodpecker” plan and planned to close about 300 stores that were not operating as expected. Finally, by June 2022, a total of 302 stores were actually closed. Then in September 2022, a “hard-core plan” was launched to reopen a number of restaurants that had been closed in the past. In 2022, 24 new restaurants will be opened and 48 closed restaurants will resume operations, but 50 restaurants with poor operating performance will also be closed.

By 2023, Haidilao stated that its primary goal is to improve store profitability and operational efficiency, and has slowed down the expansion of its restaurant network. As of December 31, 2023, Haidilao had a total of 1,374 stores in Greater China, 9 new stores were added throughout the year, 26 stores that had been closed before were reopened, and 32 more stores were closed.

From 2020 to mid-2021, it was the peak period of Haidilao’s crazy expansion. A total of more than 800 stores were opened, and the number of new stores was more than the previous 25 years combined. But from 2022 to 2023, there will be only 3 net new stores. Under the direct store opening model, Haidilao is very cautious and under pressure.

In addition, Haidilao has received more consumers, but each person has spent less money. Although Haidilao will receive 397 million customers throughout the year in 2023, an increase of 43.7% from the previous year, the unit price per customer will decrease from 104.9 yuan in 2022 to 99.1 yuan in 2023. Haidilao explained that the main reason is due to increased discounts.

Only when the table turnover rate increases can it be considered a rebound – this is one of the indicators used by the catering industry to evaluate the prosperity. In 2022, the overall table turnover rate of Haidilao restaurants in Greater China will be 3.0 times/day, which will increase to 3.8 times/day in 2023, but it is far from the 5.0 times/day in 2018. In the era of “5” turnover rate, Haidilao successfully landed on the Hong Kong stock market and was once the darling of the capital market.

“It is an impossible task and not a goal to return the (turnover rate) to 5 times.” Zhou Zhaocheng told Caijing that when Haidilao’s turnover rate reached 5 times/day, the company took the initiative to lower this number. Because when it reaches 5, it means that customers have been queuing for at least an hour. If the consumption experience is not good, Haidilao will lose customers.

When Haidilao launched the “Woodpecker” plan in 2021, it stated that if the average table turnover rate of the restaurant is less than 4 times/day, in principle it will not open large-scale stores. It is understood that Haidilao currently does not have a precise target for turnover rate, but 4 times/day is still a reference benchmark.

“At this stage, you can do some things.” Zhou Zhaocheng said, “It’s not so accurate. It has to be 4. Is 3.9 OK? It depends on the specific situation.”

According to this statement, 3.8 times/day in 2023 will be close to the situation where “something can be done”. Haidilao’s 2023 performance announcement did not elaborate on the 2024 franchise plan.

Shen Meng believes that if the company itself mainly engages in franchising, then development expectations have already entered the capital market price, but Haidilao’s expansion from self-operation to franchising will reshape investor expectations. Investors believe its growth will accelerate, adding new momentum to the company.

Shen Meng’s point of view is that the investment cost of a single store in Haidilao is high. If all investments are made by ourselves, we will be under great pressure in the current economic environment; in the face of shrinking consumer demand, independent expansion of territory will affect the liquidity of corporate operations. Security will bear greater risks. It was precisely because Haidilao encountered this kind of crisis that the “Woodpecker Project” was born. Therefore, enterprises need to find new ways to leverage social capital, “unite all forces that can be united”, and optimize growth paths.

Franchise expansion may also be an outlet for internal management and talent growth needs. Haidilao has always adopted a “master-apprentice” management model: each store manager only needs to open a new store and select an apprentice from an old store to be promoted to store manager, and they will form a formal master-apprentice relationship. Store managers can not only enjoy performance commissions for their own stores, but also receive higher percentages of performance commissions from stores managed by apprentices and apprentices. This is a kind of management and an incentive policy, which binds the interests of employees, store managers, stores, and all aspects of the company.

Chen Jianrong analyzed that the talents trained by the master-apprentice system need an outlet. Haidilao closed a number of stores in the past two years, and now there are no large numbers of stores opened. The master-apprentice system has been compressed. If there are no new stores for people to show their talents and gain more Big profits can also cause brain drain.

This wave of franchises has brought new competitive issues to the entire catering market.

“There is more and more room for franchisees to choose from. Even Haidilao has entered the market. It is getting harder and harder for us to find franchisees.” Chen Jianrong said frankly. The Weijie Catering Group he founded specializes in chain fast food and has 12 brands. In the first six years of direct operation, it only opened more than 100 stores. After joining the franchise in 2016, it now has a total of nearly 3,000 stores.

He clearly feels that since 2024, the signing rate of franchisee visits has dropped, “dropped by 10 points.” “In the past, there were no brands to choose from. Franchisees signed contracts when they came. Now they also have to shop around.” Therefore, Chen Jianrong needs to spend more energy to understand his competitors.

According to his understanding, milk tea brands with more than 7,000 stores are all competing for waist and tail franchisees, and even offer free franchise fees. They are competing for the stock market, taking unbranded and small brand stores into their own military camps. “These milk tea shops are rushing to be listed on the market. In this process, they cannot stop opening stores. Only with growth can market value be achieved.”

Chinese catering brands are becoming “chain-oriented”. According to the “2023 China Catering Franchise Industry White Paper” released by the China Chain Store and Franchise Association and Meituan, the chain level of China’s catering market will increase from 12% in 2018 to 19% in 2022.

“The high chain rate can be basically understood as the contribution of franchising, and direct operation cannot.” Chen Jianrong understands this deeply.

All franchisees are looking at the 54% restaurant chain rate in the United States and believe that China still has a lot of room for improvement. Haidilao also received high hopes as soon as it entered the market due to its first-class brand power. Talking about the impact on the industry, Zhou Zhaocheng took a step back and said: “I never thought it would be of such great significance. But if franchising is introduced through Haidilao, everyone will have a more accurate and objective understanding of the franchising model. It’s also a good thing to explore new things with Quality Franchise.”

[ad_2]

Source link