good news!China Life Wins Two Awards in the 2023 Insurance Industry

[ad_1]

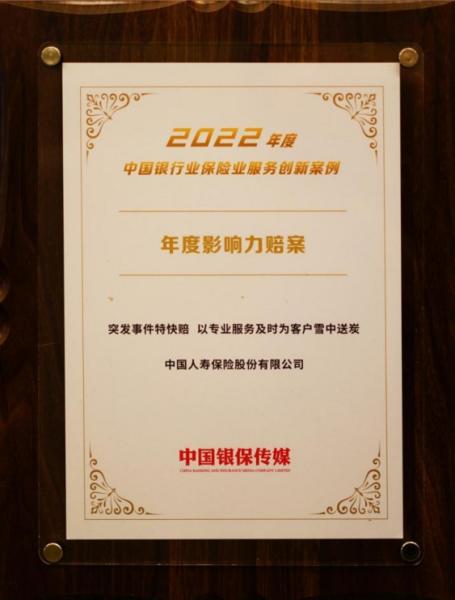

Recently, the “2023 China Banking Insurance Industry Service Innovation Excellent Case Conference and China Banking Insurance Industry Service Innovation Summit” hosted by China Banking Insurance News was successfully held in Beijing. The outstanding cases of service innovation selected this time include five awards including typical cases of consumer rights protection, typical cases of customer service, and annual influential claims. Among them, the life insurance company under China Life Group selected and reported the claim case “China Life Starts Medical Electronic Bill Claims” New Model of Service” and “Express Compensation for Emergencies: Helping Customers in Time with Professional Services” were respectively awarded “Typical case of customer service“and”Annual Impact Claims“Awards.

“Customer-centric” is the foundation of China Life’s insurance services, and providing customers with fast and warm claim settlement services is the top priority. With the continuous deepening of the digitization of the insurance industry, China Life has further expanded the application of big data, artificial intelligence and other technologies in claim settlement. Comprehensively reshape the efficient claim settlement process to provide customers with a better service experience.

Unleash the value of data elements

Carry out medical electronic bill claim settlement

In recent years, the state has comprehensively implemented the reform of the management of electronic bills for medical charges, and promoted the use of electronic medical bills. On the basis of realizing intelligent claim settlement, China Life fully combines the promotion of medical electronic bills to launch a new service model of medical electronic bill settlement. This service model realizes the direct connection of medical electronic bill data, which greatly simplifies the claim settlement service process.After being authorized by the customer, China Life intelligently identifies the customer’s medical bill information and automatically matches the customer’s insurance policy information to realize “automatic reminder and report when the customer is in danger, actively condolences to the customer to assist in claim settlement, and fast payment through intelligent operations in the background”, effectively improving the efficiency of claim settlement operations , the time limit for insurance payment is shortened by about30%.

From the perspective of customers, the medical electronic bill claim settlement service makes insurance claim settlement more convenient. Customers do not need to exchange paper bills or go to the insurance company, realizing a one-stop service from emergency medical consultation to insurance claim, which improves customer experience. In 2022, China Life will become the super1.2 millionThe customer provided a fast and warm electronic bill claim settlement service. The selected claim case of “China Life Opens a New Model of Medical Electronic Bill Claim Settlement Service” is just a microcosm of China Life’s warm service of electronic bills for these 1.2 million customers.

Take Social Responsibility

Emergency handling of major emergencies

The greatness of the country is for the people. The emergency response to claims emergencies often requires high timeliness, spreads to a wide range of groups, and has a great social impact. It is a major test of the service capabilities of insurance companies, and it is also an important manifestation of the insurance industry’s fulfillment of social responsibilities and acting as a social buffer. Based on years of practical experience, China Life has summed up a set of “System + Management + Service“Efficient and three-dimensional as the core”Express compensation for emergencies“Service system, covering the efficient response to claims emergencies, organizational system, division of responsibilities, service measures, data management and control, as well as efficient coordination with relevant government departments and external service publicity, etc., so that China Life can quickly, scientifically and efficiently Respond to emergencies in an orderly manner, provide all-round, one-stop integrated services, and protect the interests of customers to the greatest extent. “Express Compensation for Emergencies: Delivering Charcoal to Customers in Time with Professional Services” restores the China Life Insurance Group in the 6.8-magnitude earthquake in Luding, Sichuan The real process of life insurance companies quickly launching emergency plans for major incident claims, actively looking for disaster-stricken customers, and providing door-to-door claim settlement services. In 2022, China Life took the initiative to respond to 88 emergencies, involving the crash of a passenger plane of China Eastern Airlines, torrential rain and mountain torrents in Mianyang, Sichuan, and the fire at the Telecom Building in Changsha, Hunan. etc., shouldering social responsibilities with practical actions, concentrating efforts to assist in disaster relief work, and making every effort to protect the safety of people’s lives, demonstrating the mission of financial central enterprises.

In the future, China Life will continue to create “China Life Claims·quick warm“Service brand, launch more service measures that benefit customers, and constantly upgrade service experience, for “Serving the overall development of the country,Protect people’s good life“Contribute the wisdom and strength of China Life.

[ad_2]

Source link