The Shanghai and Shenzhen Stock Exchanges promote the “sunshine” review and supervision services

[ad_1]

At around 8:00 a.m. on April 25, the listing review center of the Shenzhen Stock Exchange received a call from a sponsor agency: “The company’s financial information has been updated. Can I apply for resumption of review work?”

“Hi, once the documents are ready and the application is completed, we will process it immediately. After the completion, you can check the progress on the Shenzhen Stock Exchange’s listing review information disclosure website…” The staff of the Shenzhen Stock Exchange Listing Review Center replied.

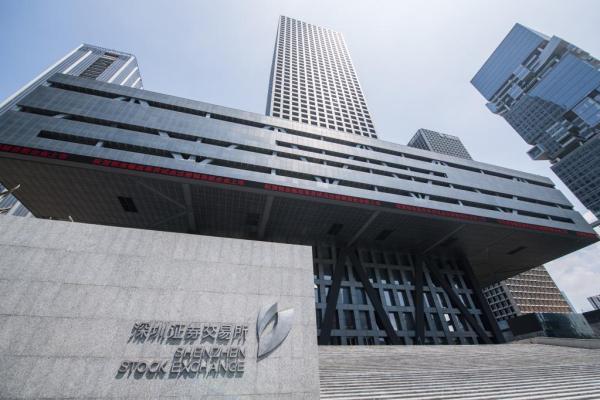

The picture shows the exterior of Shenzhen Stock Exchange.Photo by Xinhua News Agency reporter Mao Siqian

With the full implementation of the stock issuance registration system, the main responsibility for the review of corporate issuance and listing has been transferred to the stock exchange. To adapt to this change, the Shanghai and Shenzhen Stock Exchanges have introduced various systems and norms related to auditing to promote the “sunshine” auditing, supervision, and services to ensure the smooth implementation of reforms.

It is understood that the Shenzhen Stock Exchange has carried out a special action of “three sunshines and two promotions” to deepen the sunshine audit, sunshine supervision, and sunshine service, promote the improvement of audit quality and efficiency, and promote the improvement of integrity culture. The Shanghai Stock Exchange issued and implemented an action plan to further promote the “open door for review, open door for supervision, and open door for service” to improve service efficiency and continue to build a service-oriented exchange.

It is especially important for issuers and intermediaries to be able to communicate with the exchange at any time and smoothly during the period when a company declares for listing. Under the comprehensive registration system, the Shanghai and Shenzhen Stock Exchanges actively provide issuers and intermediaries with communication channels covering the entire review process.

“Before the declaration, issuers and intermediaries can conduct pre-communication on matters such as understanding and application of rules, major difficult issues, etc. During the review process, issuers and intermediaries can contact the reviewers in real time through work telephones, or through on-site, video The way to communicate with the review team on key issues is to ensure that the information of all parties is equal. After the review, the intermediary agency can rate and score in the review business area, and leave a message to comment on whether they are satisfied with the review work.” The person in charge of the relevant department of the Shenzhen Stock Exchange introduced.

In order to effectively guarantee the communication needs of market players, the SSE has optimized the consultation channels before declaration, during review and after the meeting. It is required to answer every question, reply to the consultation questions with clear opinions, and practically solve the problems; for those that are difficult to answer directly, clear review concerns and suggestions for improvement.

Haisen Pharmaceutical Co., Ltd. landed on the main board of the Shenzhen Stock Exchange on April 10. The general manager of the company, Ai Lin, said: “As one of the first batch of companies to be audited by the exchange, we feel that the regulations and guidelines are more concise and clear. The communication is more diversified, the review and registration progress is more real-time and transparent, and the cooperation with intermediaries is more active and efficient.”

It is understood that the Shenzhen Stock Exchange has recently issued a business guideline on the key points of review, guiding intermediary agencies to have more time to prepare before declaration.

Under the comprehensive registration system, in order to create a “sunshine review” and “open-door review”, the Shanghai and Shenzhen Stock Exchanges actively smoothed the entire process disclosure mechanism to improve the transparency of the review.

The Shenzhen Stock Exchange proposed to strengthen the transparency of the whole process before, during and after the event. Increase the disclosure of audit standards, and refine audit guidelines by category. Disclose typical cases, detailing the basis for the audit opinion. The SSE continues to strengthen the disclosure of audit standards by issuing business guidelines, business guidelines, and holding trainings. Relying on online channels such as stock and bond-related business systems and websites, the review process, review process, and review results are disclosed throughout.

“In terms of the review mechanism, we have strengthened the control of review power to prevent the judgment of a single person from having too much influence on the review results. At the same time, we have strengthened the internal checks and balances of the review, and carried out follow-up supervision, decision-making checks and balances, and professional checks on the review work.” Shenzhen Stock Exchange The person in charge of the relevant department said.

As a sponsoring securities firm, China Securities participated in the listing review of one of the first batch of listed companies under the main board registration system. “Under the registration system, the whole process of the company’s acceptance, each round of inquiries, the meeting of the listing committee, and the submission of registration, etc., is made public, and the issuance and listing review inquiries and the replies of the issuer and intermediary agencies are fully disclosed, and the results of deliberation and registration and related reasons and The full disclosure of facts and other information guarantees the right to know of enterprises and related parties, and at the same time enhances the binding and deterrent effects of audits.” said Liu Lianjie, member of the Investment Banking Management Committee of China Securities Investment Bank.

According to reports, in terms of creating “sunshine supervision”, the Shenzhen Stock Exchange has further placed audit inquiries in open market supervision. Optimize regulatory work standards and processes, improve daily regulatory business manuals, and strengthen the standardization of regulatory work. At the same time, increase the disclosure of daily review and supervision measures, and regularly disclose the daily punishment and on-site supervision to enhance the credibility and deterrent effect of supervision.

The Shanghai Stock Exchange has also launched a number of measures in terms of “opening the door for supervision”, including continuing to do a good job in the promotion of supervision dynamics and training, and regularly reporting the supervision work situation, typical cases and Focus on issues, and carry out weekly “Department Leaders Reception Day” activities for listed companies, and regularly hold regulatory exchange meetings for members, etc.

“The exchange regularly publishes listing review trends, reports on regulatory situations, answers market hot issues, and analyzes market hot cases, etc., which promotes the openness and transparency of review standards.” Liu Lianjie said.

In order to continuously enhance the sense of gain and satisfaction of market players, the Shanghai and Shenzhen Stock Exchanges are also actively promoting “sunshine services” and “open-door services”.

According to reports, the Shenzhen Stock Exchange discloses service telephone numbers, supervision telephone numbers, service items, and integrity commitments, establishes a service return visit system, and monitors service quality through telephone return visits. The SSE regularly monitors and evaluates the service attitude and service level of window personnel. Publicly disclose the hotlines for honest employment and complaints and complaints, and clarify the discipline of honest employment. At the same time, the Shanghai and Shenzhen Stock Exchanges continue to carry out visits, surveys and seminars to listen to the opinions and suggestions of market participants, so as to promote the transparency of issuance and listing review work.

[ad_2]

Source link