Mainland China’s TV panel share hits a two-year low, Japan and South Korea make a comeback

[ad_1]

According to data from RUNTO, in February 2024, global large-size LCD TV panel shipments were 15.6M pieces, a year-on-year decrease of 16.5% and a month-on-month decrease of 15.4%.

In February, mainland China’s panel factory’s share of shipments in the global market reached 63.5%, hitting a new low in the past two years.Both showed a downward trend compared with the same period last year, with decreases of 7.4 and 4.6 percentage points respectively.

Analysts believe that the main reason for the temporary decline in market share of panel manufacturers in mainland China is the suspension of production during the Spring Festival.

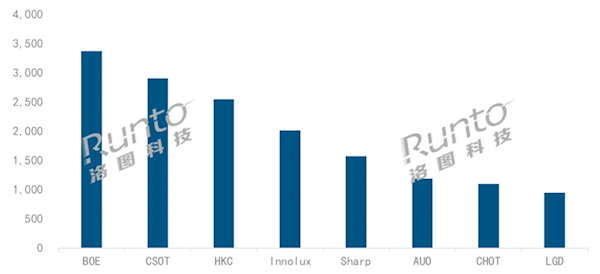

In terms of manufacturer rankings, BOE shipped approximately 3.4 million pieces in February, ranking first, but it fell by more than 20% year-on-year and month-on-month.

BOE still leads the market share in the three main size markets of 32, 43 and 65 inches, as well as the oversized 86 and 100-inch markets.

CSOT (China Star Optoelectronics) shipped approximately 2.9 million pieces in February, down more than 20% year-on-month.

CSOT’s shipments of 55- and 75-inch sizes rank first in the world, and the market share of super-large 98-inch products has been in an absolute leading position for a long time, with a market share of more than 70%.

HKC shipped more than 2.5 million pieces in February, a year-on-year decrease of 25.4% and a month-on-month decrease of 16.3%. In the super-large 85-inch market, shipment volume has firmly ranked first.

The combined market share of Taiwanese panel manufacturers Innolux and AUO was 20.5%, up 0.4 and 1.1 percentage points respectively year-on-year.

The combined market share of Japanese and Korean panel manufacturers is 16.1%, achieving year-on-month growth for two consecutive months.the monthly increases were 7.0 and 3.5 percentage points respectively.

It is worth mentioning that the production line utilization rate of LGD’s Guangzhou LCD factory has continued to increase and has now reached more than 80%. The shipment volume for the month increased by 28.9% and 12.6% respectively compared with the previous month.

After Sharp doubled its year-on-year growth in January, it continued to grow significantly by more than 50% year-on-year in February, the highest growth rate in the industry.

[ad_2]

Source link