Consumption upgrading has boosted the trend of high-end nutrition for the whole family. Last year, Jianhe’s revenue exceeded 13.9 billion yuan.

[ad_1]

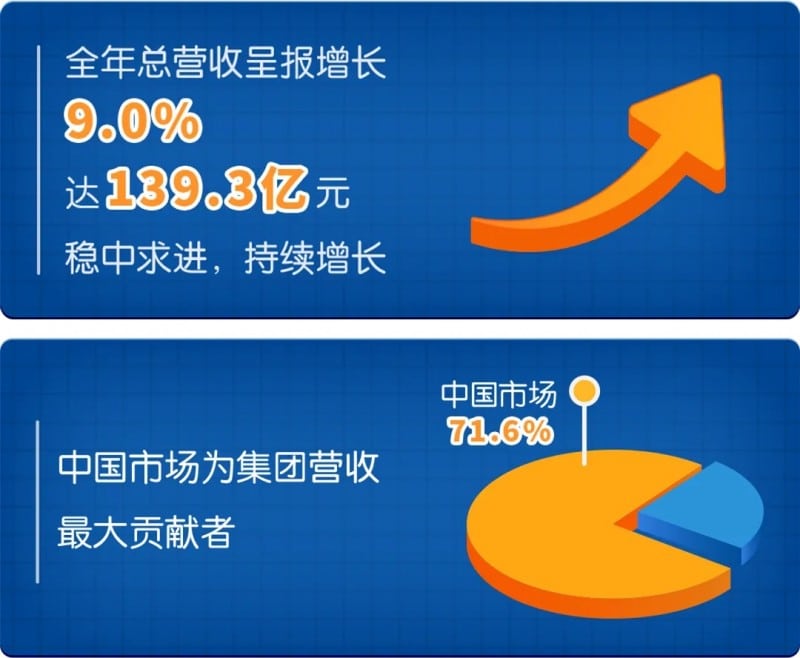

Hianhe Group, which has transformed ahead of schedule, is making further progress in the family nutrition track. On March 26, Hianhe Group (1112.HK) announced its 2023 performance report, which showed that during the reporting period, it achieved revenue of 13.93 billion yuan, a year-on-year increase of 9.0%; adjusted EBITDA was 2.22 billion yuan, an increase of 12.4%. Among them, the Chinese market performed well, with a year-on-year increase of 4.0% to 9.97 billion yuan, accounting for 71.6% of the group’s total revenue.

From the perspective of the overall business composition, although H&H Group started in the maternal and infant field, as the in-depth transformation of family nutrition continues to advance, nutritional supplements have become the main engine of the group’s growth, and nutritional supplements 1 among the three major businesses have been realized Rapid growth30.0%accounting for 1% of the group’s total revenue60.4%and continues to drive profit growth, especially when the global annual sales of its subsidiary Swisse exceed AU$1 billion. This is undoubtedly an important turning point in the long-term development of Jianhe, which started out as an infant and young child nutrition and health business.

Behind this is Hianhe Group’s advance layout of the family’s health and nutrition strategy. Some analysts pointed out that with the advent of the great health era, people’s health awareness has increased significantly, and the demand for various nutritional categories continues to rise. Jianhe has made technological innovations in its products according to changing trends, comprehensively upgraded its products in subdivided areas, built competition barriers, and highlighted its strong operational resilience and long-term competitiveness.

Swisse’s rapid growth Nutritional supplements become growth engine

For a long time in the past, H&H Group’s annual reports generally put the performance of its infant nutrition and care business (BNC) first. However, in this financial report, the first place was adult nutrition and care business (BNC). Nursing Products Business (ANC).

Although this change is small, it is a rotational replacement of old and new kinetic energy.

Data shows that in 2023, Hianhe Group’s nutritional supplement business revenue has exceeded that of the milk powder business, accounting for 60.4% of the group’s total revenue. Among them, the adult nutrition and care products business has become an important source of performance for the group, with revenue reaching 6.14 billion yuan, a year-on-year increase of 34.1%. It has become an important tool for Jianhe to overcome industry cycles and maintain resilient growth.

In particular, Swisse’s performance was the most eye-catching. During the reporting period, Swisse’s Chinese market achieved a year-on-year growth of 37.4%, accounting for 66.0% of the group’s ANC sales. At the same time, Swisse grew by 28.7% year-on-year in the Australian and New Zealand markets, becoming a key code for H&H to maintain resilient growth through the business development cycle.

Swisse’s success is closely related to its accurate grasp of the nutrition and health market trends. On the one hand, Swisse seizes the opportunity of the explosive demand for nutrition and health and forms the “Swisse 1+3” brand strategic matrix through its brands Swisse PLUS, Swisse Me, and Little Swisse. On the other hand, it reaches the minds of consumers through multi-faceted interactions and launches the brand marketing 3.0 strategy to guide consumers from brand mind to category mind, further increasing stickiness with consumers.

In addition, Biostime infant probiotics and nutritional products, as well as Solid Gold and Zesty Paws pet supplements under the Health & Hope Group also achieved rapid growth. During the reporting period, Hianhe Group’s BNC business achieved revenue of 5.91 billion yuan, and the infant probiotics and nutritional supplements business increased by 9.1% year-on-year; the pet nutrition and care products business (PNC) achieved revenue of 1.87 billion yuan, a year-on-year increase of 18.2% %.

Jianhe said that in the future, Solid Gold will continue to increase nutritional supplement categories in the Chinese market and further improve the product supply layout in the Chinese and American markets; Zesty Paws will also continue to increase its presence in all channels. Provide support for healthy nutrition and health layout for the whole family.

From the perspective of the industry, at present, H&H Group has completed the whole family nutrition and health of the adult nutrition and care products business unit (ANC) + infant nutrition and care products business unit (BNC) + pet nutrition and care business unit (PNC). The industrial layout has redefined the innovative model of nutrition and health for the whole family, from infants and young children to adults and seniors.

Consumption upgrade drives high-end trend countrySpeeding up international layout

With the slowdown of China’s demographic dividend and fierce market competition and other factors, the decline in infant formula milk powder has further narrowed, and it has transformed from an incremental market to a stock market. Therefore, the high-end market is becoming the main battlefield for leading companies to compete, and the trump card in the competition is high-end single products, as well as the formula, milk source and technology research and development that support high-end products.

In 2023, Biostime, a subsidiary of Jianhe, will further strengthen its ultra-high-end milk powder category layout. The financial report shows that as of December 31, 2023, Biostime’s seven major infant milk powder series have passed the “New National Standard” certification of the State Administration for Market Regulation and successfully completed the omni-channel transition.

According to data from independent research data provider Nielsen, the retail sales of Biostime’s ultra-high-end infant formula milk powder accounted for 12.4% of the market share, and its market share increased, ranking 4th.

Not only that, Biostime has strengthened the international layout of its infant formula milk powder business. While expanding its share of French pharmacy channels, it has launched the “Inostime” series of infant formula milk powder in France containing lactoponin LPN and breast milk oligosaccharide HMO. During the reporting period, the market shares of Biostime organic infant formula milk powder category and goat milk in French pharmacy channels were 41.6% and 41.9% respectively.

According to dairy industry expert Song Liang, the high-end and ultra-high-end markets are battlegrounds for leading companies. First of all, these companies need high-end products to increase profits because operating costs are increasing, and the capital market has also put forward requirements for them; secondly, they are leaders. A consideration of brand strategy for all enterprises. High-end products can largely play a role in maintaining the corporate brand image; thirdly, high-end competition mainly focuses on technology research and development and product innovation. Whether it can compete for a market place tests a company’s R&D strength has also led to the accelerated elimination of some small and medium-sized enterprises in the competition in the high-end market.

[ad_2]

Source link