The cooperation between the police and the bank has shown results, and Haier Consumer Finance assisted the police in cracking down on the case of fraudulently obtaining and modifying credit reports by forging certificates

[ad_1]

In recent years, Haier Consumer Finance Co., Ltd. has attached great importance to the linkage between the police and the bank, and established a coordination and communication mechanism with the public security organs. The company’s legal affairs lead the company’s security investigation, and timely investigate the fraud clues and illegal activities found in various channels, and found suspected illegal crimes According to the facts, we immediately reported the case to the public security organs, and jointly cracked down on illegal and criminal acts against financial institutions, which achieved good results.

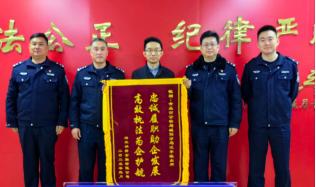

In August 2021, the China Banking and Insurance Regulatory Commission issued the “Notice on Further Strengthening the Rectification of Complaints from Consumer Finance Companies and Auto Finance Companies”, clearly proposing to seriously investigate and deal with criminals who seriously disrupt the overall construction of the social credit system. A few days ago, Haier Consumer Finance Co., Ltd. (hereinafter referred to as “Haier Consumer Finance”) assisted the Chengyang Branch of the Qingdao Municipal Public Security Bureau to successfully crack a case of forging certification materials to complain to a financial institution for fraudulently obtaining credit objection amendments.

It is understood that Gai, a customer, complained to Haier Consumer Finance before, requesting to delete his overdue credit records, and provided written proof. In the process of screening the certification materials provided by Haier Consumer Finance staff, they found that there was an obvious abnormality in the seal of a listed company in the certification materials, and preliminarily judged that there were forged certification materials. Haier Consumer Finance immediately reported the case to the public security organ where the listed company was located in response to the abnormal clues of illegal crimes found. After accepting the case, the Chengyang Branch of the Qingdao Municipal Public Security Bureau attached great importance to it, quickly carried out investigations and other related work, visited and investigated the listed companies involved in the case many times, and believed that Gai was indeed suspected of violating the law. After a comprehensive investigation and big data sorting, Gai’s work unit was determined and coercive measures were taken to summon him. Under pressure from the public security organs, Gai truthfully confessed the illegal fact that he forged the certification materials of enterprises and institutions in order to modify his overdue credit report. At the same time, Gai also fully realized the seriousness of his illegal behavior and issued a written letter of repentance promising to repent. Currently, the case is under further processing.

In recent years, the state has introduced a series of epidemic relief financial policies to support economic development. For qualified overdue financial loan customers, policy support for handling credit objections can be provided. However, in the process of implementing the series of policies, some criminals also forged the official seals and certification materials of enterprises and institutions to defraud policy support.

[ad_2]

Source link