Deep digital bill legal science popularization: focus on anti-money laundering measures to maintain the bottom line of safety in the bill industry

introduction

In the process of business development, all ticket-using companies may encounter situations where their bank accounts are suddenly blocked, or the public security organs require cooperation in investigations, etc., and they are often confused and helpless. The root cause of this phenomenon is that the bill industry has entered a stage of rapid development in recent years, and the development vitality of the bill market has increased significantly, attracting the attention of many criminals who attempt to launder their criminal proceeds and gains through bill transactions. Many companies or bill market entities are so difficult to distinguish that they have become tools for criminals to use, and some companies have even gradually developed the illegal intention of helping money laundering under the influence of the surrounding bad atmosphere.

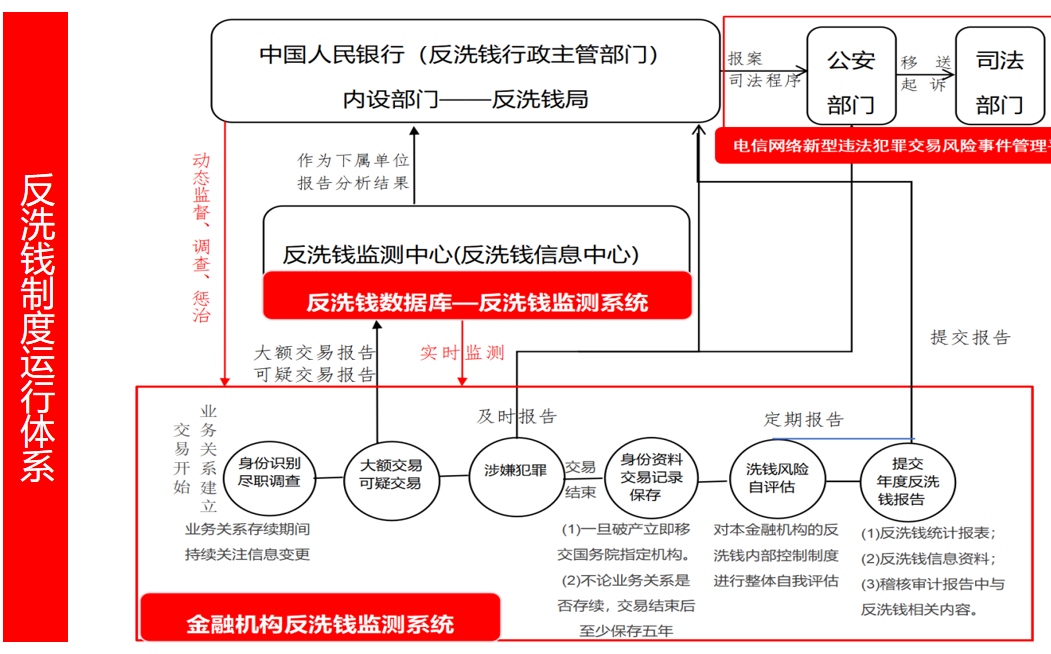

Money laundering crimes have become a cancer that cannot be ignored in the bill industry and must be eliminated. To this end, Deepin Digital Group will show you how the anti-money laundering system operates from three perspectives: market participants, administrative departments and judicial organs, in order to answer confusion and help you better understand the current anti-money laundering related measures and obtain The results will enhance the awareness and emphasis of various bill-using companies on anti-money laundering work, and further contribute to the construction of a more standardized, transparent and efficient bill market system!

1. Market participants—financial institutions

Financial institutions, as key players on the front line in the anti-money laundering system, mainly include policy banks, commercial banks, credit unions, trust investment companies, securities companies and other institutions. Among them, the bill industry has the most contact with various commercial businesses. bank. According to the Anti-Money Laundering Law, the Self-Assessment Guidelines for Money Laundering and Terrorist Financing Risks of Legal Person Financial Institutions, the Measures for the Management of Reporting of Large-Amount and Suspicious Transactions by Financial Institutions, financial institutions not only have the general person in charge of their anti-money laundering work Responsible for, specially appointed senior executives to be responsible for anti-money laundering self-assessment work, and also set up a special anti-money laundering agency or designate an agency to specifically deploy and implement anti-money laundering work in accordance with statutory anti-money laundering obligations. At the same time, detailed and strict anti-money laundering obligations have been set for financial institutions:

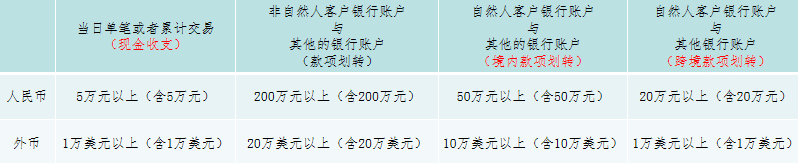

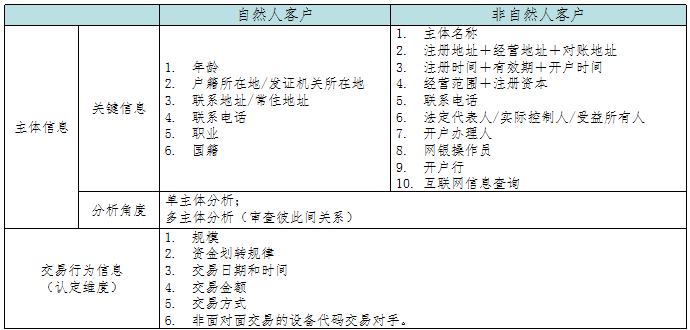

1. Take the reporting obligations of large-value transactions and suspicious transactions as an example. When cash receipts and payments, transfers of funds, and domestic and cross-border transfers of funds in bank accounts reach a certain amount, financial institutions must report large-amount transactions to the People’s Bank of China (referred to as the “Central Bank”) in a timely manner; Comprehensive comparison and analysis of the identity information and transaction behavior information of abnormal transaction subjects. If financial institutions confirm or suspect suspicious transactions with the risk of money laundering crimes, they need to report to the central bank immediately regardless of the amount of funds.

2. According to relevant laws and regulations on anti-money laundering, financial institutions must establish their own anti-money laundering monitoring system to connect with the anti-money laundering monitoring system of the People’s Bank of China to monitor, screen, transfer, investigate, and freeze suspicious transactions in business transactions. and other money laundering risk behaviors. The two sets of anti-money laundering monitoring systems work independently and jointly monitor and combat criminal money laundering activities to prevent money laundering risks. They are an important part of my country’s anti-money laundering system.

Taking ICBC as an example, it comprehensively uses its own business development form, scale, data information and other resources to independently establish an intelligent anti-money laundering system to monitor and analyze customer fund transactions with direct or indirect business transactions. Its functional anti-money laundering system covers big data analysis, artificial intelligence and other technical support, more than 1,000 anti-money laundering experts real-time attention and update of anti-money laundering laws and policies, 29 suspicious screening indicators, multi-level financial relationship network and other system designs, effectively combating A criminal act in which criminals launder money through bank accounts.

2. Anti-money laundering administrative department—The People’s Bank of China (referred to as the “Central Bank”)

As the anti-money laundering administrative department stipulated in the Anti-Money Laundering Law, the People’s Bank of China supervises money laundering crimes in various fields. It has specially established the Anti-Money Laundering Bureau as an internal agency. It is the central bank’s main responsibility for combating anti-money laundering crimes and strengthening anti-money laundering supervision. institutions to strengthen the leadership, coordination and overall planning of anti-money laundering work. Mainly responsible for organizing and coordinating anti-money laundering work, taking the lead in formulating anti-money laundering policies and regulations, supervising the performance of anti-money laundering obligations by financial institutions, analyzing large-value and suspicious transaction information provided by the anti-money laundering monitoring center, and conducting anti-money laundering investigations.

At the same time, an anti-money laundering monitoring center has been established as the central bank’s anti-money laundering information center, which is an important legal entity in my country’s anti-money laundering framework. Since its establishment, the Anti-Money Laundering Monitoring Center has played an important role in anti-money laundering and provided strong financial intelligence support for law enforcement agencies to combat money laundering and related crimes. Its main responsibilities are to collect, analyze, judge and save information on large-value and suspicious transactions; transfer suspicious clues to relevant departments and assist in investigations; it is worth noting that it is also responsible for the construction and management of the national anti-money laundering database, and research and development of anti-money laundering databases. Money laundering information receiving and monitoring analysis system.

The People’s Bank of China mainly has the following supervisory and punitive measures for illegal activities suspected of money laundering:

1. Administrative penalties

Enumerate some of the following circumstances. The People’s Bank of China will order financial institutions that have the following circumstances to make corrections within a time limit; if the circumstances are serious, they will be fined according to different circumstances or recommend that the China Banking Regulatory Commission, China Securities Regulatory Commission or China Insurance Regulatory Commission revoke their licenses, as well as the directors and directors directly responsible for them. Executives and other directly responsible personnel are prohibited from practicing or subject to disciplinary sanctions:

(1) Failure to establish an internal control system for anti-money laundering as required, and failure to establish or designate a specialized agency to be responsible for anti-money laundering work;

(2) Failure to provide anti-money laundering training to employees in accordance with regulations, and failure to submit large transaction reports or suspicious transaction reports;

(3) Conduct transactions with unidentified customers or open anonymous accounts or pseudonymous accounts for customers;

(4) Violating confidentiality regulations and leaking relevant information; refusing or obstructing anti-money laundering inspections and investigations;

(5) Refusing to provide investigation materials or deliberately providing false materials.

2. Anti-money laundering investigation

The People’s Bank of China scientifically deploys regulatory forces, carries out on-site inspections in a standardized and effective manner, embeds anti-money laundering regulatory requirements in industry regulatory rules, and builds a complete regulatory chain covering before, during and after the event.

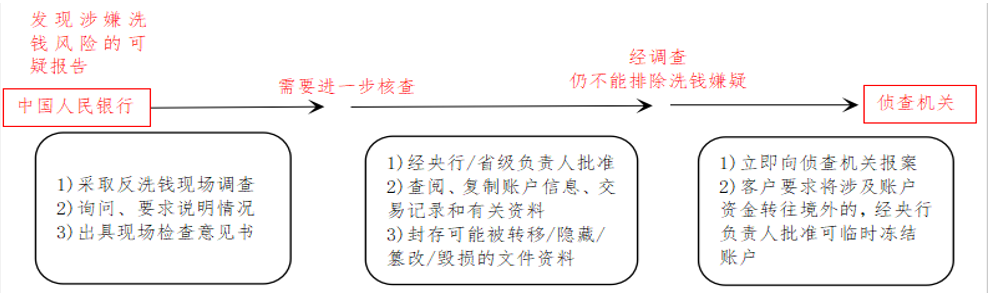

Once the People’s Bank of China discovers suspicious transactions through its own anti-money laundering monitoring system and anti-money laundering database, or through suspicious transaction reports handed over by financial institutions, it will immediately launch an anti-money laundering investigation and has the right to temporarily freeze bank accounts if necessary. If the suspicion of money laundering cannot be ruled out after an anti-money laundering on-site investigation, the People’s Bank of China should immediately report the case and transfer criminal clues to the public security organs and other supervisory and punitive measures, realizing the integration of administrative measures and criminal judicial measures from the discovery of suspicious transactions to the punishment of criminal acts of money laundering. Effective connection at all levels.

According to the table, the “Overall Situation of Anti-Money Laundering Investigations and Assistance” issued by the People’s Bank of China in 2022 discloses its anti-money laundering investigations and subsequent transfers to investigation agencies to assist in prosecutions, reflecting the People’s Bank of China’s use of the anti-money laundering monitoring system to monitor suspicious transactions suspected of money laundering. The effectiveness of a series of supervisory and punitive measures such as anti-money laundering investigations after crimes and subsequent transfer of criminal clues.

3. Anti-money laundering measures of judicial organs-legislature, public prosecutors and law

1. The “Procedure Regulations for Public Security Organs in Handling Criminal Cases” stipulates that public security organs have the right to inquire and freeze suspicious accounts suspected of money laundering for the purpose of investigating crimes. Among them, for major and complex cases, with the approval of the person in charge of the public security agency at or above the level of a districted city, the freezing period can be up to one year, and the freezing period can be extended up to one year. That is to say, once you are involved, your account will be frozen for a year and a half. At the same time, it is also possible that based on the “background” of this implication, the two sides of the People’s Bank of China and financial institutions will be involved in future business development and capital transactions. The anti-money laundering monitoring system will focus on it, so it is more likely to be frozen than normal ordinary accounts, and the negative impact on one’s own business development will undoubtedly be huge.

The “Notice on Matters Concerning Strengthening Payment and Settlement Management to Prevent New Illegal Crimes in Telecom Networks” focuses on the need for public security organs to strengthen the management of inquiry, payment stop, and freezing of accounts involved in the case. Banks and payment institutions should handle the inquiry, payment stop and freeze of the involved accounts initiated through the new illegal and criminal transaction risk event management platform of the telecommunications network immediately, provide inquiry for transactions within the past two years, and support inquiry of the same day’s transactions and provide timely feedback. If the query feedback results exceed 1,000 transaction information, the most recent 1,000 transactions will be fed back; for canceled accounts, the query of transaction details before account cancellation is supported. In line with the concept of resolutely cracking down on illegal crimes and showing no tolerance, the public security organs carried out “simultaneous” freezing of related accounts and assets suspected of money laundering crimes based on abnormal fund trends, resulting in a wide range of implicated and frozen accounts. Through the new illegal and criminal transaction risk event management platform of the telecommunications network, a large amount of transaction information can be obtained promptly and quickly, and the accounts involved can be inquired, paid, and frozen. This is why everyone encountered the problems mentioned at the beginning of the article.

2. The procuratorate has prosecuted more and more money laundering crimes in recent years. Taking the data of the procuratorate’s prosecution of money laundering crimes as an example, from 64 people were prosecuted for money laundering crimes in 2018 to 590 people were prosecuted for money laundering crimes in 2020. By the end of 2023, it had reached 2,971 people, and the number of prosecutors has increased exponentially. It is expected that the prosecution and tracing of money laundering criminals will continue to increase in the future.

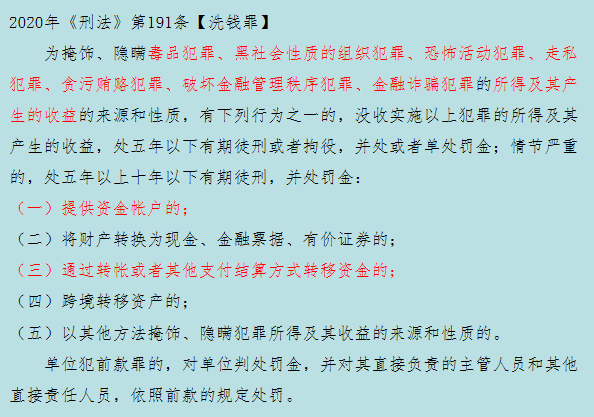

In terms of conviction and sentencing, the court found that the scope of the current predicate crimes of money laundering is not limited to 7 specific crimes, but should be understood as 7 categories of crimes, that is, including all crimes under each category of crimes. For example, one of the predicate crimes: organized crime of a mafia nature refers to[all crimes committed by organizations of a mafia nature that can generate criminal proceeds and benefits].

This is the ultimate manifestation of the “Criminal Law” continuously expanding the scope of predicate crimes, behavioral subjects, behavioral methods and other aspects of money laundering crimes and breaking the limit on the amount of fines through four amendments and one judicial interpretation of the Supreme People’s Court over the years. Relevant state departments continue to Tighten the living space for money laundering criminals.

To sum up, from the market participants at the front line of business, that is, banks and other financial institutions, to the specific performance of anti-money laundering obligations and the monitoring and reporting of illegal money laundering activities, restrictions on transactions, and temporary freezing, to the anti-money laundering administrative department, the People’s Bank of China, for countermeasures. From the design of the money laundering system and supervision and punishment, to the investigation, prosecution and conviction of suspected money laundering by the public prosecutors, law and judicial organs, every link is interlocking and interconnected. All departments and agencies coordinate with each other to ensure that capital transactions are carried out in a multi-faceted and comprehensive manner. The process is carried out under the increasingly strict anti-money laundering system, so that money laundering criminals have nowhere to hide.

Here, Deepin Digital Group solemnly calls on all bill-using companies to adhere to the principles of legal compliance and prudent operation, and actively fulfill their reporting obligations for suspected money laundering behaviors discovered, jointly build a security line of defense for the bill industry, and resolutely crack down on money laundering crimes. , to maintain industry order and ensure the healthy and stable development of the industry!