Chengdu Huiyang Investment: Regarding the rise in pig prices in the off-season, the market trend is improving, and the investment sector is increased

[ad_1]

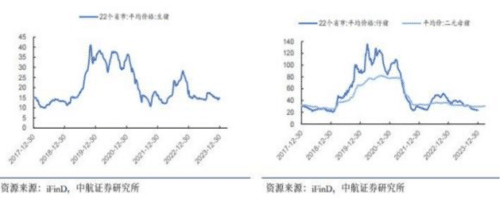

As of March 22, the average price of sampled live pigs in Yongyi nationwide was 15.1 yuan/kg, standing above the 15 yuan mark, a week-on-week increase of 4.2%. Historically, the months after the Spring Festival have been the off-season for pig consumption throughout the year. On the supply side, the theoretical number of pigs to be slaughtered is calculated based on the number of sows that can reproduce in the early stage. Recent months have also been the peak of pig supply. Against the background of low market expectations, pig prices have gradually recovered after adjustments after the Spring Festival, and have risen strongly recently, raising market expectations for the later pig market. Piglet prices also reflect that the industry is generally optimistic about the market outlook. In the week of March 21, the slaughter price of 15 kilogram piglets at the Yongyi sample farm was 631 yuan/head, a rapid increase of 12.5% week-on-week.

The long-term market trend is improving

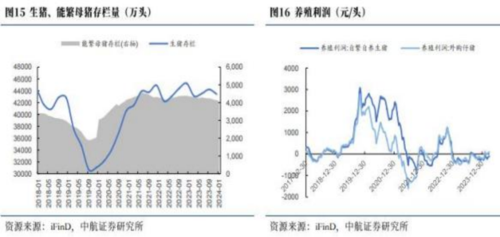

On the supply side, considering the transmission of production capacity reduction in the early stage, it is expected that the peak supply of live pigs will pass, and industry supply may gradually shrink in the second quarter; on the demand side, considering the CPI data in recent months, we are optimistic about the resilience of domestic consumption recovery, and in the future as pig consumption seasonally picks up. , is expected to promote the pig market. In terms of production capacity, as of January 24, the official national stock of reproductive sows was 40.67 million, which is 104.3% of the normal stock and 1.67 million higher than the normal stock target. Major pig enterprises have still to be eliminated. The financial pressure of time and the reduction of overall industry production capacity are expected to further boost the long-term expectations of the pig market.

The valuation of the pig sector is low, it is recommended to choose the opportunity to make allocations

Sales of pig companies slowed down in February: In terms of volume, judging from the sales data of 12 pig companies that have been announced, (excluding Muyuan and Aonong) pig sales in February totaled 4.9177 million heads, a month-on-month decrease of 30.89%. Among them, the sales of Dabeinong and Wen’s Co., Ltd. dropped month-on-month this month, with a decrease of 48.6% and 27.1%. In terms of price, the overall supply and demand of live pigs in February shrank due to the Spring Festival holiday, and the overall market fluctuated within a narrow range. According to Yongyi Consulting, the national average pig slaughter price in February 2024 was 14.41 yuan/kg, an increase of 0.14 yuan/kg from the previous month, a month-on-month increase of 0.98%, and a year-on-year decrease of 2.83%. The average slaughter weight increased. In February, various breeding entities accelerated their sales to avoid the sales gap during the Spring Festival holiday, and the average slaughter weight also declined. According to Yongyi Consulting, the average slaughter weight of pigs nationwide in February was 121.27 kilograms, a decrease of 2.04 kilograms from January, and a month-on-month decrease of 1.65%. In terms of breeding profits, the industry’s breeding profits continue to suffer losses. According to iFinD data, as of March 22, 2024, the profits of self-breeding and self-raising and purchased piglet breeding were -104.83 yuan/head and 89.44 yuan/head respectively.

As of March 22, the pig industry index (931845.CSI) closed at 1363.54 points, and the PB valuation was still at the 0.1 percentile in the past five years. We believe that “valuation is the base and catalysis is the sail”. Maintaining the safety margin of sector valuation and grasping the expected catalysis of pig prices is a better strategy for configuring the pig sector at present.

Related companies

Wen’s Shares (300498):Wen’s Food Group Co., Ltd. (“Wen’s Food Group” for short) was founded in 1983 and has developed into a trans-regional modern agricultural and animal husbandry enterprise group with livestock and poultry breeding as its main business and supporting related businesses. On November 2, 2015, Wen’s shares were listed on the Shenzhen Stock Exchange (stock code: 300498). As of December 31, 2021, Wen’s Co., Ltd. has 402 holding companies, approximately 45,400 cooperative farmers (family farms), and approximately 44,000 employees in more than 20 provinces (municipalities and autonomous regions) across the country. In 2021, Wen’s listed 13.2174 million pigs and 1.101 billion broiler chickens, achieving operating income of 64.954 billion yuan. Wen’s Co., Ltd. is now a national key leading enterprise and innovative enterprise in agricultural industrialization. It has established important scientific research platforms such as the National Pig Seed Industry Engineering Technology Research Center, the National Enterprise Technology Center, the Postdoctoral Research Workstation, and the Key Laboratory of the Ministry of Agriculture. It has a team of A high-quality scientific and technological talent team with more than 20 industry experts and 64 PhDs as R&D leaders. Wens Co., Ltd. masters key core technologies in livestock and poultry breeding, feed nutrition, disease prevention and control, etc., and has a number of advanced breeding technologies at home and abroad.

Muyuan Shares (002714):Muyuan Food Co., Ltd. was founded in 1992 and went public in 2014. A pork industry chain has been formed that integrates feed processing, pig breeding, pig breeding, slaughtering and processing. Muyuan has always adhered to the vision of “let people eat safe pork” and is committed to producing safe, delicious and healthy high-quality pork food for society, improving the quality of life of the public and allowing people to enjoy a rich life.

[ad_2]

Source link