Behind the postponement of Ping An Trust products: the project sell-through rate is about 21%

[ad_1]

Recently, a piece of news with text and pictures “The postponement of Ping An Trust products has triggered customer complaints and rights protection” has been widely circulated on social media, causing Ping An Trust, which has assets under management of more than 600 billion yuan, to once again attract attention. What exactly happened?

Picture from Ping An Trust subscription account public account

Funing No. 615 Trust Plan Extension Notice on the Expiration Day

On March 29, Ping An Trust issued a temporary announcement on major matters of the Funing No. 615 collective fund trust plan, and that day was the expiration date stipulated in the trust contract.

According to reports from Brokerage China, Ping An Trust told relevant investors that due to the downturn in real estate, the thunderstorm of project development company Zhenrong Real Estate, and the need for sales funds to enter regulatory accounts, as of the announcement date, the trust plan has not yet recovered cash. The trust plan It is postponed to the date when all the trust property is sold or the date when the surviving beneficiaries expect the trust benefits to be fully distributed (whichever comes first).

Recently, a text and picture message saying “Ping An Trust Products Delayed, Triggering Customer Complaints and Rights Protection” went viral on social media.

On April 10, Ping An Trust issued a statement saying that due to the overall downturn in the real estate market, Ping An Trust’s Funing No. 615 trust plan has recently been postponed. The company deeply apologizes for the trouble this has caused to customers. Currently, Ping An Trust is actively promoting project disposal by continuing to follow up on the development, sales and capital withdrawal of the target projects, filing lawsuits against the repurchase obligor Zhenrong, and promoting the transfer and exit of the target equity held by the trust plan.

According to information on the official website of Ping An Trust, Ping An Trust Funing No. 615 Collective Fund Trust Plan was officially established on September 29, 2021. According to the website of China Trust Registration Co., Ltd., Ping An Trust Funing No. 615 collective fund trust plan, the first application date for registration is October 12, 2021, and the duration is 30 months. The main investment industry is the real estate industry, and the fund utilization method is: Long-term equity investment.

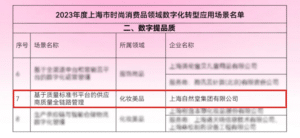

Picture from the website of China Trust Registration Co., Ltd.

Is the “good brand property” you invested in not selling well?

According to reports from Brokerage China, the trust plans to raise 772 million yuan to invest 70% of the equity in Xiamen Ronglu Real Estate Co., Ltd., thereby indirectly investing in the “Zhenhuafu” project under the name of Xiamen Lienzhengyue Investment Co., Ltd.

On April 10, Sino-Singapore Finance checked the APP of a real estate agency and found that the opening time of “Zhenhua Mansion” is December 11, 2021, with a reference average price of 28,000 yuan/square meter. The property is in the sales list of Xiamen Haicang Ranked fifth and ranked among Zhenrong Group’s “good brands”.

However, according to Jiemian News, the product previously announced that due to the downturn in real estate, the sale of the underlying projects was slow. The total sales area of the “Zhenhuafu” project (excluding parking spaces) is 100,505.60 square meters, including 98,546.95 square meters of residential units, 1,029 planned residential units, 33 commercial units, and 1,029 parking spaces. As of the announcement date, Zhenhuafu has sold a total of 218 units (21 residential units and 7 commercial units), received sales of 523 million yuan, and has a sell-through rate of approximately 21%.

The above-mentioned APP shows that the developer of “Zhenhuafu” is Xiamen Lienzhengyue Investment Co., Ltd., and the property company is Zhengrong Property.

Xiamen Lianzhengyue Investment Co., Ltd. is an affiliated company of Ping An Trust and Zhengrong (Xiamen) Real Estate Co., Ltd.

The Tianyancha website shows that Xiamen Lianzhengyue Investment Co., Ltd. is a subsidiary of Xiamen Lianrongyue Real Estate Co., Ltd. The shareholders of Xiamen Lianrongyue Real Estate Co., Ltd. include: Lianfa Group Co., Ltd. (actual controller, holding 49% of the shares), Xiamen Ronglu Real Estate Co., Ltd. (holding 49% of the shares), Fujian Longyi Landscape Engineering Co., Ltd. (holding 49% of the shares) 2% of shares). As for Xiamen Ronglu Real Estate Co., Ltd., Zhengrong (Xiamen) Real Estate Co., Ltd. holds 51% of the shares and Ping An Trust holds 49%.

Picture from Zhenrong Real Estate 2023 Annual Report

Zhengrong Real Estate will have a net loss of 8.468 billion attributable to its parent company in 2023

Zhengrong Fang, the repurchase obligor mentioned by Ping An Trust in its statement on April 10.

The official website of Zhenrong Group declares that Zhenrong Group was founded in 1998 and is a national comprehensive investment holding group headquartered in Shanghai, China. Its subsidiary Zhenro Real Estate was listed in Hong Kong in 2018. Its comprehensive strength ranks among the top 20 of China’s top 100 real estate companies. .

According to Zhengro Real Estate’s 2023 annual report, in 2023, Zhengro Real Estate’s revenue was 38.775 billion yuan, and its net loss attributable to the parent company was 8.468 billion yuan. As of the end of 2023, Zhengrong Real Estate’s total assets were 153.2 billion yuan, total liabilities were 147 billion yuan, and equity attributable to parent shareholders was -3.889 billion yuan.

Ping An Trust in the incident is a holding subsidiary of China Ping An Insurance (Group) Co., Ltd.

Ping An China’s 2023 annual report shows that as of the end of December 2023, Ping An Trust’s assets under management were 662.503 billion yuan. As of December 31, 2023, Ping An Trust’s net capital was 19.609 billion yuan. The sum of net capital and risk capital of various businesses The ratio is 322.7%, and the ratio of net capital to net assets is 75.3%.

[ad_2]

Source link