What signal does the global central bank’s large-scale gold purchase send?

[ad_1]

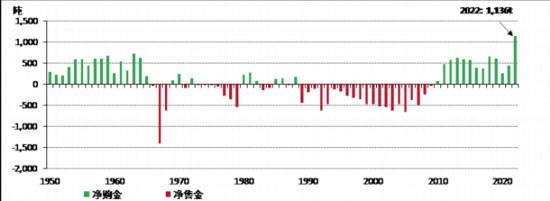

In recent years, the central banks of various countries have started the “buy, buy, buy” model to increase their gold reserves. “Global central banks will purchase 1,136 tons of gold in 2022, a record high, and this trend will continue in 2023.” According to a report released by the World Gold Council a few days ago.

This report uses data and cases to describe the strong start of the central bank’s gold purchases this year: in the first two months, the Monetary Authority of Singapore purchased 51.8 tons of gold; the central bank of Turkey and the central bank of India are also buying gold…

It should be noted that the international gold price has fluctuated widely in recent years. However, no matter whether the price rises or falls, the pace of global central banks’ continuous purchase of gold is always moving forward. Obviously, its underlying logic is different from that of ordinary investors investing in gold. How should we understand it?

“A survey we conducted in more than 50 central banks around the world in the first half of last year showed that ‘performance in times of crisis’, ‘hedging inflation’ and ‘long-term value-preserving assets’ are the main driving factors for central banks to hold gold.” World Gold Council China CEO Wang Lixin said.

According to him, in the above-mentioned survey, 61% of the central banks surveyed expect that the global central banks will increase their gold reserves in the next 12 months.

In 2022, the global central bank’s gold purchases will break historical records. (Source: Metals Focus UK, World Gold Council)

As a special asset, gold, a shiny precious metal, has multiple attributes of finance and commodities. It has been widely used as a general equivalent for a long time in human history, and its hedging and anti-inflation characteristics are particularly popular.

Therefore, although it cannot directly bear interest, in practice most central banks around the world have a place for gold in their international reserves. According to actual needs, countries dynamically adjust the portfolio allocation of international reserves, including gold, to ensure the safety, flow, and value preservation and appreciation of their international reserve assets.

In the past year, Russia and Ukraine have been full of gunpowder, geopolitical tensions, and global inflation have reached a new high in more than 40 years. Driven by these two factors, the central banks of various countries have increased their gold holdings to a new climax. It is not surprising.

In addition, some analysts believe that, in addition to economic environment and geopolitical considerations, seeking to diversify foreign exchange reserves and reduce excessive dependence on the US dollar to deal with the instability of the US dollar-centered international monetary system is also an important issue for some central banks. It is an important driving force for the central banks of emerging market economies to increase their holdings of gold.

After the outbreak of the international financial crisis in 2008, the Federal Reserve issued a quantitative easing policy and printed money wantonly, and its domestic crisis was transmitted to the world through the US dollar; Debt costs are rising, and some countries are even in currency or debt crises…

After experiencing the above-mentioned crises, many countries have begun to increase their efforts to increase reserve assets such as gold and special drawing rights, promote the diversification of foreign exchange reserve assets, and actively explore the path of currency multipolarization by reducing their holdings of US debt and promoting bilateral currency agreements. .

The data from the World Gold Council clearly shows the turning point of the trend of global gold reserves change – in 2010, global central banks and public institutions ended the previous 20 years of “net gold sales” and started a new round of “net purchases”. into” process. Including 2022, central banks have made net purchases of gold for 13 consecutive years.

A staff member of a gold shop displays Lunar New Year gold bars. Published by Xinhua News Agency (photo by Zhao Xiaoming)

At present, the international gold price is close to the highest point in history. Will the trend of central banks increasing their gold holdings stop? There doesn’t seem to be any sign of that yet. In fact, in addition to being favored by central banks of various countries, some sovereign wealth funds have also shown greater interest in allocating gold.

At the end of last year, Russia adjusted the asset limit of the National Wealth Fund. The new regulations stipulate the potential upper limit of investment assets, among which the maximum limit for investment in RMB and gold has doubled.

The Australian Future Fund pointed out in a recently released position report that global investors may face the challenges of low growth, high unemployment and high inflation in the future. To make its portfolio more resilient, the fund has turned to gold and other real assets.

“With people’s further understanding of gold’s hedging and value-preserving properties, coupled with the drive of diversified demand for foreign exchange reserves, we believe that central banks of various countries will continue to purchase gold in 2023, but the specific purchase volume and whether new purchases will be created Records are hard to predict,” Wang Lixin said.

[ad_2]

Source link