Tianjin Rural Commercial Bank actively carried out the “3.15” consumer rights protection publicity and education activities

[ad_1]

In order to effectively protect the legitimate rights and interests of financial consumers, improve consumers’ financial literacy and awareness of rights and responsibilities, and stay away from illegal financial activities, Tianjin Rural Commercial Bank organized the “3.15” consumer rights protection publicity and education campaign. Coordinated and cooperated to form a full network of “online + offline”, “concentrated + positional” financial publicity, and launched a series of outstanding and effective special activities.

Relying on the advantages of outlets to establish the main front for popularizing financial knowledge

Tianjin Rural Commercial Bank takes outlets as its propaganda positions, makes full use of channel resources, and rolls out promotional content through LED screens and LCD TVs in more than 400 outlets across the bank. In order to help consumers understand financial risks more intuitively and conveniently, the bank designed the “Financial Risk Prevention Handbook”, which popularized the knowledge of consumption and investment traps, illegal financial advertising traps, pension fraud traps, etc. in the form of a combination of pictures and texts, and made it into a publicity Folds are distributed to consumers. Each branch set up a publicity activity team to carry out the “five entry” activities centering on the outlets, such as entering the community, entering the school, entering the countryside, entering the enterprise and entering the business district, and carried out more than 500 offline publicity activities of various types in total. “Precise marketing” for key groups such as the old, the young, and the new, etc., to popularize financial knowledge.

Helping Rural Revitalization Send Financial Knowledge to Rural Areas

In order to further strengthen the dissemination of financial knowledge in rural areas, Tianjin Rural Commercial Bank took advantage of the popularity and geographical advantages of its agriculture-related outlets, combined with the characteristics of rural areas, the actual needs of rural residents for financial products and services, and the problems and difficulties encountered in investment and financial management. etc., extensively carry out characteristic publicity activities, promote financial education to reach the “last mile”, and give full play to the important role of financial knowledge popularization in promoting rural revitalization.

Jizhou Liao Sub-branch delivers financial knowledge to villagers’ doorsteps

Jizhou Central Sub-branch went to Xiaying Town Market to carry out publicity activities

Join hands with all walks of life to build a new pattern of financial knowledge popularization

Taking this “3.15” publicity campaign as an opportunity, Tianjin Rural Commercial Bank actively cooperates with government departments, public security, schools, community streets and other sectors of society to jointly carry out multi-channel, multi-level and multi-form publicity activities, and work together to create a bright spot, Influential financial popularization activities will build a new pattern of financial knowledge popularization with widespread participation by the whole people.

Dongli Xinli Sub-branch and Lixinli Community jointly held financial knowledge lectures for the elderly

Baodi Central Sub-branch and Baodi District Financial Bureau launched the theme of “Information Accessibility” to help the elderly bridge the “digital divide”

Dongli Wuxia Sub-branch and Huashengli Community jointly carry out financial knowledge “bench classroom”

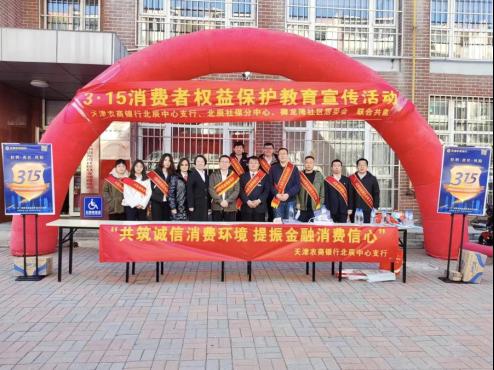

Beichen Central Sub-branch is jointly established with Beichen Social Security Branch Center, Beichen Public Security Bureau Internal Security Branch, and Yulongwan Party-mass Service Center

Participate in the public welfare publicity of financial knowledge organized by the Tianjin Branch of the People’s Bank of China and the Tianjin Financial Dispute Mediation Center

Promoting the “Finance and Integrity” popularization education activities to send financial knowledge into the campus

Tianjin Rural Commercial Bank took the initiative to connect with primary and secondary schools, went into the classroom to popularize financial knowledge to primary and secondary school students, helped students learn finance, understand finance, and use finance, cultivate the values of honesty and trustworthiness from an early age, and help promote the construction of a social credit system. During the event, Tianjin Rural Commercial Bank went to Balitai No. 1 Primary School, Dongli District Lixian Primary School, Jinghai No. 3 Primary School and other schools, and led students to understand the types of RMB by watching video clips, physical explanations, and interactive games. As well as the method of identifying counterfeit currency, guide students to consciously love RMB and refuse to use counterfeit currency. At the same time, through small cases of financial stories, explain “what is integrity”, and guide students to establish a correct view of financial management and values of honesty and credit.

Balitai No. 1 Primary School Finance Classroom

Jinghai No.3 Primary School Finance Classroom

Expand online publicity channels and carry out risk warnings in depth

Tianjin Rural Commercial Bank makes full use of digital technology to empower financial knowledge promotion, and continuously expands the depth and breadth of financial education. Create promotional materials such as WeChat long pictures and short videos, and carry out risk warnings in a form that is popular with the masses, reminding consumers to be vigilant against financial scams and stay away from illegal financial activities. Published long publicity pictures such as “Risk Reminders on Early Repayment and Mortgage Refinancing” and “Warning! Online Games Make Money Trap” on publicity platforms such as WeChat public account and video account; produced and released MG animation short video “Moldy Brain Anti-Cheat” It reminds consumers, especially young people, to enhance their awareness of risk prevention during the use of the Internet, and to be alert to Internet fraud traps, which has received widespread attention from the public.

Next, Tianjin Rural Commercial Bank will continue to promote financial knowledge popularization and education activities, establish a long-term mechanism for publicity and education, create more excellent publicity works, give consumers timely risk warnings, earnestly fulfill the main responsibility of financial education, and effectively strengthen people’s The sense of gain, happiness, and security of the masses, and practical actions to practice finance for the people and consumer protection for the people.

[ad_2]

Source link