The Harmony Health Insurance Company you think may actually be like this

[ad_1]

Most of us pay attention to the brand when we buy things, and it is no exception when buying insurance. When many people buy insurance, the first sentence is “Which insurance company is this?” If they have not heard the name, they will think it is a “small” insurance company, and most of the names of the “big” insurance companies they know are fixed in a few, and almost all others are classified as “small”.

So, when buying insurance, does the size of the insurance company really matter? Do insurance companies really have “size” points? Not really. Take Harmony Health Insurance Company as an example. Many people may hear the name of this insurance company for the first time and take it for granted that it is a “small” insurance company.

But the fact is that Hexie Health Insurance Co., Ltd. was established in 2006 with a registered capital of 13.9 billion yuan and its headquarters is located in Beijing. What is the concept of 13.9 billion yuan? To give a simple example, in December 2022, the market value of the number one company on the Beijing New Third Board is only 10.089 billion yuan.

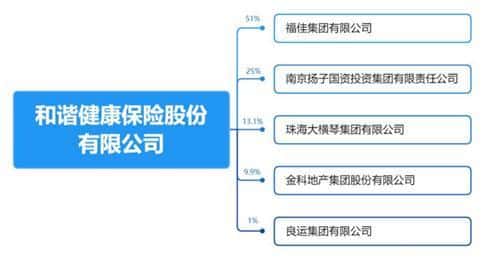

In my country, insurance is a highly regulated industry. The China Banking and Insurance Regulatory Commission is very strict in the qualification review of insurance companies. Any company that can obtain an insurance license has very strong strength. In March 2020, Harmony Health completed the equity delivery. Fujia Group Co., Ltd., Nanjing Yangzi State-owned Investment Group Co., Ltd., Zhuhai Dahengqin Group Co., Ltd., Jinke Real Estate Group Co., Ltd. and Liangyun Group Co., Ltd. became the new shareholders of the company .

Up to now, Hexie Health has 15 provincial branches, 15 provincial branches, 37 central branch companies and 5 branch companies across the country, basically forming a service network covering the whole country.

Why do we not hear much about such insurance companies? In fact, this may just be because the marketing strategies of various insurance companies are different. For example, some insurance companies pay more attention to building corporate brand awareness, while others are committed to providing consumers with better insurance products and more practical protection.

On the other hand, we also need to understand that the most important thing about buying insurance is the insurance contract. We need to understand the specific protection content of the insurance we buy and know what to insure. That is to say, the essence of buying insurance is actually buying Protection is the most important thing to look at the insurance contract and choose the insurance product that suits you.

[ad_2]

Source link