The future of digital intelligence is good and prospering? Looking at the new vision of Industrial Bank’s digital transformation from the Digital China Construction Summit

On April 28, the 6th Digital China Construction Summit came to an end in Fuzhou, Fujian. With the theme of “accelerating the construction of digital China and promoting Chinese-style modernization”, this summit will focus on displaying the latest achievements in the construction of digital China. As the only national joint-stock commercial bank headquartered in Fuzhou, this is the sixth consecutive year that Industrial Bank has participated in the Digital China Construction Achievements Exhibition, and the exhibition will last until the 30th of this month.

When I came to the exhibition hall of Industrial Bank, a modern “Surfing the River at Qingming Festival” that integrated urban and rural areas came into view. The four exhibition areas of “helping a better life”, “serving the real economy”, “helping rural revitalization” and “strengthening the digital base” drew a number of technologies The empowerment scene vividly demonstrates the new development prospect of serving the construction of digital China with “digital prosperity”, and witnesses that Industrial Bank’s “building the ability to connect everything and creating the best ecological empowerment bank” has continuously reached new heights.

With the full blooming of technology-driven and ecological empowerment, Industrial Bank is deeply implementing the action of “strive for excellence, dare to be the first, and strive for efficiency” to accelerate digital transformation. “Outlet business development” is moving towards “digital business development”, adding new momentum to the development of high-quality services.

Ramping the Digital Base

Use digital twin technology to connect the real computer room and the virtual computer room one by one and data connection, realize real-time intelligent monitoring of the operation of the computer room, and finally achieve the good effect of “unmanned operation and maintenance”;

The intelligent anti-fraud platform with intelligent identification and interception of financial fraud as the main function uses the industry-leading “batch-flow integration” framework and “flow cube” engine, with a processing capacity of 30,000 transactions per second. Since its launch four months ago, a total of Intercepted 270 million yuan of fraudulent funds, and firmly guarded the “money bag” of the people;

Last year, 625,900 digital real-name wallets were opened, becoming the first bank to launch digital wallets for compatriots in Hong Kong, Macao and Taiwan… As the 10th designated digital renminbi operator, Industrial Bank continues to expand digital renminbi application scenarios, making digital financial services more Close to the masses and benefit the whole people;

Metaverse, anti-fraud, digital twins, digital renminbi… At this Digital China Construction Summit, Industrial Bank fully demonstrated the results of its iterative and agile development. Behind it, it is inseparable from the bank’s continuous strengthening of the digital foundation.

Adhering to the digital transformation as a battle of life and death, Industrial Bank deepened the reform of the technological system and mechanism, launched the implementation of the plan for ten thousand talents in science and technology, continued to increase investment, strengthen talents, build scenarios, build platforms, and expand customers, and rejuvenated and upgraded Industrial Pratt & Whitney and Industrial Manager The “five major online platforms”, Xingye Life, Qianda Shopkeeper, and Yinyin Platform have implemented the “five major enterprise construction projects” of marketing, wealth, investment banking, operation, and risk control, and have done a lot of basic, pilot, and strategic work. In the past two years, Industrial Bank has invested more than 8.2 billion yuan in technology, and the number of scientific and technological personnel has reached 6,699. The proportion of scientific and technological talents in the group has increased by 5.41 percentage points to 11.87% compared with the end of the previous year.

Help a better life

To activate the market potential, “Industrial power” is hidden in every payment.

In the Xingye Life APP, a series of rich and colorful consumer welfare activities such as instant discounts, discounts, and low-price flash sales have brought multiple surprises to cardholders, allowing the general public to enjoy consumption, enjoy benefits, and enhance their sense of happiness.

According to reports, as an interesting and trendy online digital paradise, Xingye Life currently has more than 40 million users, and 800 million people experience trendy games such as blind boxes, tree planting, sports, and currency counting online every year.

Under the empowerment of digitalization, the number of retail customers of Industrial Bank exceeded 91 million last year, among which the scale of wealth management and the number of individual pension accounts opened ranked third among joint-stock banks.

Whether it is Qianda Shopkeeper, which has more than 15 million users and covers more than 5,800 wealth products from 190 institutions after 10 years of hard work, or Xingtai, which covers more than 1,000 communities in more than 30 regions across the country and provides community life and financial services. Behind the beautiful, interesting and rich experience of the e-home rental and housing integrated service platform is the unremitting efforts and exploration of Industrial Bank to continue to promote the diversified integration of “finance + technology + life” and fully satisfy the people’s yearning for a better life.

Serving the real economy

In the “Serving the Real Economy” exhibition area, the Xingye Pratt & Whitney Platform with 21 online financing products is widely welcomed by enterprises.

According to reports, one of the Xingye Pratt & Whitney platforms is a financing product for government procurement customers. By locking customers’ repayments and calling customers’ taxation, industrial and commercial information, etc., there is no need for additional credit enhancement, and the risk can be controlled for customers. Offer reasonable pricing.

“Clients can know in a minute whether they can get a loan and how much they can borrow, and they can get a loan in as little as half an hour, which effectively solves the problems of ‘difficult, expensive, and slow financing’ that small and micro enterprises worry about.” On-site at Industrial Bank The staff said.

In recent years, Industrial Bank has taken the initiative to integrate into the production and operation scenarios of enterprises, and has jointly built a digital platform with enterprises and industrial parks to help enterprises cross the “mountain of financing”. Among them, the Xingye Pratt & Whitney platform has been online for more than a year, and has realized system and business connection with more than 740 platforms across the country, and solved more than 35,000 financing needs for 35,700 companies, with an amount exceeding 140 billion yuan.

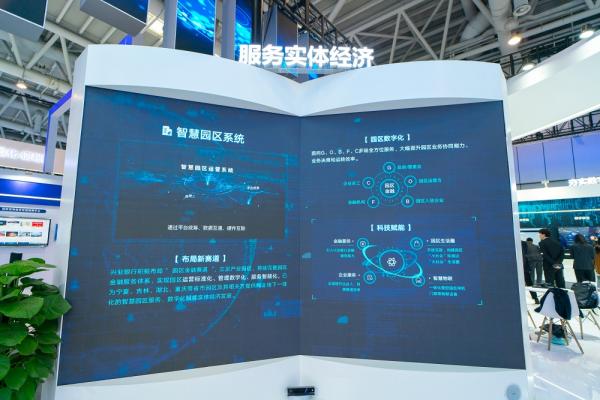

Serving the real economy is the bounden duty of finance, and the Industrial Bank has always resonated with the real economy, co-existing and co-prospering. Digital products launched around core enterprises and upstream suppliers—the digital supply chain is actively solving financing problems in small-amount, high-frequency, and weak-guarantee scenarios; digital products that are deployed on the new track of park finance—smart parks are cooperating with the government , parks, and enterprises jointly build a platform to empower the digitalization of the park; Xingye Steward is providing enterprise customers with the service of “managing money” + “managing affairs” in the whole process of production and operation…

Riding on the wind of digitalization, Industrial Bank continues to improve its ability and level of serving the innovation, coordination, green, open, and shared development of the real economy, and takes actions and practices to “strive for the vastness and make the most of the subtleties”. Last year, Industrial Bank’s corporate finance customers exceeded 1.2 million, and the balance and increase of corporate inclusive loans ranked first among joint-stock banks.

support rural revitalization

Undoubtedly, in the vast world of rural revitalization, Industrial Bank is constantly exporting “Industrial Wisdom”, sending wealth products and technological capabilities to the vast countryside.

As the first interbank cooperation brand launched in China, the Industrial Bank’s interbank platform helps the high-quality development of rural finance by gathering the power of financial peers. “On the one hand, financial services are extended to the vast counties, towns, rural areas and remote areas in my country. In Fujian Province alone, rural credit institutions in 66 counties, districts and cities in the province have been covered; on the other hand, technological capabilities have been transferred to There are more than 220 rural credit institutions across the country, such as rural commercial banks, rural credit cooperatives, and village banks, so that residents and enterprises in rural areas can also share high-quality digital services.” The relevant person in charge of Industrial Bank said.

In the “Supporting Rural Revitalization” exhibition area, the biological asset supervision platform uses technologies such as the Internet of Things + AI to make live biological assets creditable and monitorable, and solve the problem of difficult financing in the past animal husbandry; use satellite remote sensing technology to integrate “Sky Eye” and Combining with AI, capitalize and credit tea gardens, forest farms and other planted crops, and innovate financing methods; independently develop photovoltaic service platforms, and use blockchain + AI technology to make rural photovoltaic power generation monitorable and measurable, and farmers can use photovoltaic loans to build Photovoltaic power stations to create additional income; explore the use of new technologies such as the Internet of Things and satellite remote sensing to introduce financial water into pastures, tea gardens, and forest farms.

Through more efficient, convenient and affordable financial service solutions, Industrial Bank is continuously injecting financial vitality into rural revitalization and development. Last year, Industrial Bank ranked first among joint-stock banks in terms of incremental agriculture-related loans.

With the continuous advancement of the construction of digital China, Industrial Bank will, as always, take science and technology as the primary productive force and innovation as the primary driving force, face the new era, use “new technology”, create “new finance”, and build a leading digital bank , to realize self-evolution to adapt to changes in production relations in the digital age. And the innovative vitality unleashed by “Digital Industrial Development” will also promote the high-quality development of Industrial Bank to achieve a new leap.