Sued by Jay Chou for unfair competition, Netease game encounters bottleneck of explosion

[ad_1]

Recently, Jay Chou sued NetEase for an unfair competition case, on the grounds that NetEase game “Tianxia 3” gave away his new album and concert tickets without his authorization. From the perspective of NetEase, NetEase hopes to create a long-lived hit game to drive the company’s performance to achieve faster growth, but it is not easy to create a hit game.

In response to Jay Chou’s recent lawsuit against NetEase for game infringement, “Red Weekly” consulted a legal person. The person said that NetEase’s behavior does have a risk of infringement. But judging from Jay Chou’s claim of 2 million yuan, the impact on NetEase, which has a revenue of nearly 100 billion yuan, is minimal. In contrast, games are the core business of Netease, and its revenue growth is slowing down and whether popular products can continue are the topics that investors focus on.

Explosive product “life cycle” is shortened

The growth rate of the main game industry has slowed down

For NetEase, the game business, which accounts for more than 70% of its operating income, is its core business. But this core business showed a slowdown in growth last year. From a full-year perspective, NetEase’s 2022 operating income will be 96.496 billion yuan, a year-on-year increase of 10.15%, while Netease’s game and related value-added service revenue will be 74.567 billion yuan, a year-on-year increase of 9.95%, which is lower than the company’s overall growth rate.

“Red Weekly” reviewed the company’s annual financial reports and found that the revenue growth rate of NetEase games and related value-added services in 2022 also hit a new low in the past five years. The data shows that from 2018 to 2021, the operating income of this business will be 40.19 billion yuan, 46.423 billion yuan, 54.609 billion yuan, and 67.819 billion yuan, with growth rates of 10.8%, 15.51%, 17.63%, and 24.19%, respectively. Even the revenue growth rate in 2018 is higher than the 9.95% level in 2022.

In 2021, the high growth of NetEase’s game and related value-added service business is mainly due to the launch of its popular game “Harry Potter: Magic Awakening” mobile game. Once the game was released, it topped the download list. According to gamma data calculations, the first month of its launch in 2021 will reach 1.1 billion yuan. But it was also in the process of the gradual decline in the popularity of “Harry Potter: Magic Awakening”, and the growth rate of NetEase’s game business revenue dropped to single digits.

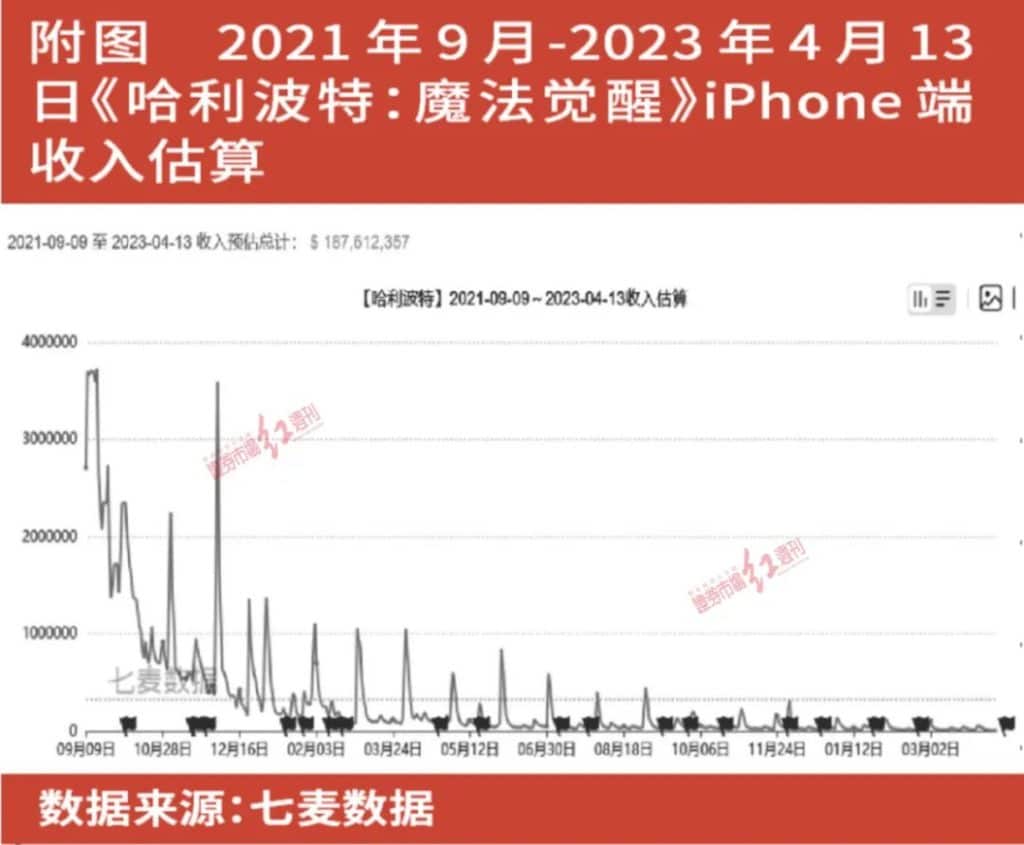

Taking the income of the iPhone as an example, according to the calculation of Qimai data, the income of “Harry Potter: Magic Awakening” from September 2021 to the end of 2021 will be 135 million US dollars, and the income from September 2021 to April 13, 2023 will be about 188 million Dollar. Since 2022, its revenue has declined rapidly, with quarterly revenue from the iPhone side dropping to $24.65 million, $13.02 million, $6.79 million, and $4.82 million, respectively. The speed of its “heat dissipation” and the speed of income reduction can be seen (see attached photo).

Regarding the reasons for the decline in the popularity of “Harry Potter: Magic Awakening”, Ge Jia, a well-known Internet analyst, believes that “big IP games will be more popular when they first go online, but playability is the key to determining their long-term popularity. NetEase launched The game often has more than exquisite graphics, but not enough playability.”

A player Xiaowei (pseudonym) who has “abandoned the pit” told “Red Weekly”: “I am a Harry Potter fan and I am interested in IP, so I played this mobile game, but with the friends playing around me It’s gradually decreasing, and I don’t want to play anymore. I’m currently playing “Original God.” According to Xiaowei, “Harry Potter” is a card game with a weak plot. The main activities are fighting, taking classes, and playing dungeons. In the process of playing, you will find the shadow of many other games, such as dancing is played like a rhythm master, and the Quidditch game is similar to Temple Run. She said, “My favorite project is the history of magic class. In the process of answering questions, it can always bring back memories of the original book.”

But feelings are no match for reality after all. Xiaowei said frankly: “I am a free player. Dungeons like the Giant Spider Territory are too difficult for me, but it is difficult to pass the level without spending money.” In the mouths of many players, the “Harry Potter” mobile game It got the evaluation of “both liver and krypton”, that is to say, it consumes both energy and money. At the beginning of its launch, the game scored more than 9 points on TapTap, but it has now dropped to 6 points.

Currently, the decline of “Harry Potter: Magic Awakening” is more obvious. According to Qimai data, as of April 19, “Harry Potter” ranked 357th among iPhone games (free) and ranked 48th among card games (free). The revenue in the most recent quarter was US$2.6923 million, which is a further decline from the data for each quarter in 2022. Combined with the cooling rate of this game in the past two years, it may mean that it will be difficult for this game to create higher turnover for NetEase this year.

after breaking up with blizzard

NetEase loses more than just revenue

In addition to changes in game revenue, the impact of the suspension of cooperation between NetEase and Activision Blizzard at the beginning of the year is still being concerned by the outside world. On January 23 this year, Activision Blizzard ended its licensing agreement with NetEase, and games such as “World of Warcraft”, “Overwatch”, “Hearthstone” and “StarCraft” series all suspended their services in mainland China (that is, “stop service”). ”), the 14-year collaboration came to an abrupt end.

Activision Blizzard’s operating income accounts for a relatively high proportion of NetEase’s agency game business. According to NetEase’s annual report, in 2021, the revenue of mobile games and end games authorized by third-party developers will be 8.356 billion yuan, accounting for 9.5% of NetEase’s total revenue. It is understood that Blizzard’s agency revenue accounts for about 80% of NetEase’s total agency game revenue.

Although Netease stated that “the revenue and profits of games represented by Blizzard account for a relatively small proportion, which has limited impact on the company’s performance. Reducing the number of games represented by the company will also help the company’s gross profit margin to further increase. In the future, self-developed games will be launched one after another after obtaining the version number, which may bring considerable revenue. Incremental growth will drive the company’s performance to continue to grow.” However, on November 17, 2022, the day when Blizzard officially announced that it will end its cooperation with NetEase, the negative sentiment in the market was intense, and its Hong Kong stock NetEase-S stock price pulled a big negative line, falling by as much as 10%. 9.05%. Afterwards, Everbright Securities released a research report stating that Blizzard’s game distribution rights will cease to affect market sentiment, and at the same time have a small negative impact on revenue, and lowered the company’s 2023 revenue forecast to 108.2 billion yuan, a drop of 4.6% from the previous forecast. percentage point. Some people point out that although this part of revenue accounts for only single digits, it is a rare, long-term, and stable income for game companies.

In this regard, Ge Jia pointed out that Netease and Blizzard ended the cooperation, and the loss is multi-level: “The most important loss is the user. If the user is divided into levels, the users of “World of Warcraft” are undoubtedly the most expensive, and the acquisition cost is high. However, their spending power and payment ability are strong, and their user stickiness and loyalty are also relatively high. They are some users that game companies dream of. Secondly, in terms of game aftermath, game user refunds, game commemorative medals, etc., Part of the responsibility may fall on NetEase.”

Xiaoye, a World of Warcraft player who has been playing World of Warcraft for more than ten years, told Red Weekly: “After the service is stopped, the refund speed is relatively fast, and the account arrives in 2-3 days, which shows that NetEase is the refund account. And the game achievements are kept in Blizzard. The tool provided saves the data package, commonly known as ‘electronic urn’.” He said that before the service was stopped, he would log in to this game every day, and he could play for up to ten hours a day, and he had tried other similar games. But the sense of experience is poor, and the final result is a long-term love for “World of Warcraft”. Regarding the krypton metal nature of this game, he has different views: “If you play “World of Warcraft” for a long enough time, you can be given a point card, so basically the ‘liver’ is greater than the ‘krypton’.” But there are also opinions that, Most of the loyal users of “World of Warcraft” are working parties aged 30+, and they are the most capable group of people.

Netease is optimistic about “Egg Party”

Difficult to become a phenomenon-level explosion

After the popularity of “Harry Potter” faded and the cooperation with Blizzard ended, the haze that NetEase suffered was dispelled a little after the explosion of “Egg Party” during the Spring Festival this year. “Egg Party” will be launched on December 24, 2021, but in the scene of the Spring Festival family carnival in 2023, its download volume surpassed “Glory of the King” and “Peace Elite” to rank first, and its daily active users also exceeded 30 million, becoming the game with the highest daily active users in NetEase’s history.

According to Wired Insight, according to Data.ai data, “Egg Party” entered the top 100 best-selling list for the first time on October 28, 2022, and its ranking rose significantly during December. Starting from December 23, 2022, it has dominated the App Store game free list for two months.

After the popularity of “Egg Boy Party”, NetEase CEO Ding Lei is quite confident about the future development of this game. He said at the financial report: “In the future, we will invest more in research and development and operation, and do a good job in the long-term service of the game. Here The ‘long term’ I think is at least 10 years.”

On the basis of more than 20 years of experience in operating products such as “Fantasy Westward Journey” and “A Chinese Westward Journey” in the past, it seems that NetEase’s 10-year service for “Egg Boy Party” is not a problem. However, in the process of moving from the era of terminal games to the era of mobile games, the life of the game is also experiencing the fact that the life of the game is constantly shortening: In addition to the “Harry Potter” mentioned above, the mobile game “Onmyoji”, which was more popular before, has been online for two days. The popularity also dropped rapidly after the year.

It should be pointed out that “Egg Party” seems to be no exception. After the Spring Festival, its popularity is rapidly dissipating: according to the data of sensor tower’s global mobile game publisher revenue list, “Egg Party” still ranked first in January “, dropped rapidly to No. 6 in February, and regressed at an even faster rate in March to No. 18.

Liao Xuhua, senior consultant of Analysys culture industry, told “Red Weekly”: “The data of sensor tower does not include mainland Android, which has limited reference value for the mainland market. It is the proper position of “Egg Boy Party” to rank outside the top ten. It is determined by its category. The results of the Spring Festival can only be said to be an unexpected explosion. I believe Netease also has a very clear understanding. “Egg Party” cannot rank above the mainstream heavy games for a long time, but from the current point of view, As a long-term and stable leading casual game, there is no problem.”

The key to improving valuations is

Break through the barriers of long-term hits and social traffic

What about the competitiveness of NetEase’s other games? Liao Xuhua said, “The company’s relatively new IPs such as “The Shore of the Land”, “Endless Lagrange”, “The Cold Against the Water” and “After Tomorrow” are leading in both market segments and the overall market.”

He further stated: “Netease’s core competitiveness lies in its self-research capabilities. They have enough and experienced R&D teams, and their R&D capabilities in many market segments are even stronger than Tencent’s, which is beyond the reach of other domestic companies. Yes. But Netease does not have a long-term blockbuster with a large MAU (monthly active user), nor does it have global blockbusters such as “Yuan Shen”, “Awakening of Nations”, and “Puzzle & Survival”. That is to say, with Tencent, Mihayou, Lily Compared with Silk and Sanqi Huyu, NetEase still lacks in some aspects, which is unavoidable.”

Ge Jia also pointedly pointed out: “NetEase mobile games have always had the problem of driving high and low. If this is printed in the company’s research and development genes, it would be terrible. NetEase’s games have good graphics and well-made production, but they are not well-received. The game idea It is very different from Tencent. Tencent is a studio that launches games based on horse racing. NetEase is developed by a professional team, which is relatively sunny, but it is unwilling to invest as much as Mihayou (the company of “Yuan Shen”), and has a strong sense of risk. , lacking the spirit of stud. There is more than spring and snow, and there is not enough wealth and frugality.”

However, in Ge Jia’s view, under the environment where the game life cycle is shortened, game companies compete for update frequency, new games are constantly launched, or more charging points are set in the game to make money, NetEase has long-term hit games “Fantasy Westward Journey” and “Fantasy Westward Journey”. The “old money” of “A Chinese Journey to the West” is edible, and it has won time for transformation and research and development for itself.

Ge Jia said, “Tencent has become the most competitive game company by relying on cheap customer acquisition channels such as WeChat and QQ. However, if NetEase wants to compete with it and achieve a transformational leap, the acquisition of traffic is very important.” According to He introduced that NetEase’s social ecology is mainly email, which is much weaker in comparison. It has also developed social apps such as Huatian (marriage and dating platform) before, but they have not achieved good results.

“Red Weekly” learned from a certain Netease game player that there are two main channels for him to obtain information, one is the press conference, and the other is the promotion of the big anchor. Yes, it’s a pity that the game experience is not good. After the anchor quit, everyone stopped playing. In addition, the recent promotion of short videos can also obtain game information. And these approaches are no different from other game companies.

At present, the stock price of NetEase’s Hong Kong stock is around 140 Hong Kong dollars, while the stock price of the US stock is around 90 US dollars, and the rolling price-earnings ratio is about 20 times. In Ge Jia’s view, unlike Tencent, which is valued as an Internet company, NetEase is usually valued as a game company in the secondary market, so it is difficult to obtain a higher valuation. In order to obtain an increase in valuation, long-term hits and social traffic are barriers that NetEase cannot ignore and wait to break through.

[ad_2]

Source link