Minsheng Bank’s Tianjin Baidi Road Sub-branch launched a series of publicity activities on “3.15” consumer rights protection

In order to practice the political and people-oriented nature of financial work, continue to deepen the “customer-centric” business philosophy, fulfill our social responsibilities, help improve people’s financial literacy, boost financial consumption information, and build a harmonious and healthy financial consumption environment, Tianjin Baidi Road Sub-branch of Minsheng Bank took advantage of the “3.15” consumer rights protection activity to carry out a series of promotional activities online and offline.

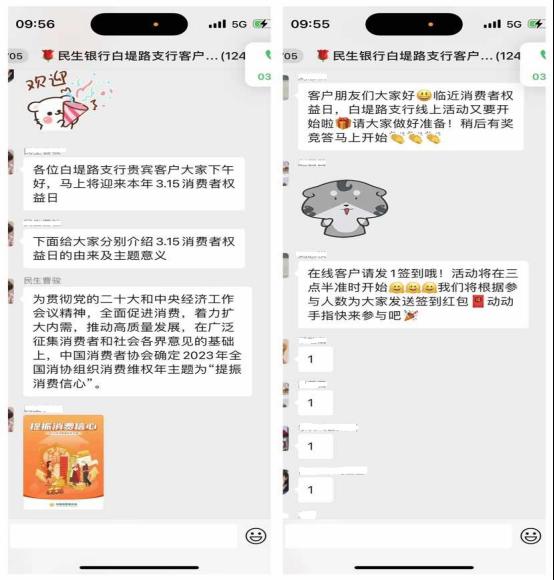

Enhance penetration of online promotion

At the beginning of the activity, the service manager of the sub-branch forwarded the Minsheng Bank 3.15 publicity week launch video and the original promotional materials of the branch to the online public, and used a combination of video and comics to explain the recent cases that harmed the rights and interests of consumers to remind customers Protect your own rights and prevent telecom fraud. Afterwards, related questions were raised about the content of the presentation, and a quiz with prizes was organized to actively respond to customers and eagerly answer them. Finally, our sub-branch once again used branch promotional materials to remind customers to keep in mind the eight rights and interests of financial consumers, and told them to be cautious in financial consumption. The event was well received by customers and received high response from customers.

Co-promoting offline publicity services

Conduct publicity in the hall, distribute publicity leaflets and explain the basic knowledge of financial needs on the spot, publicize and popularize basic financial concepts, start with daily financial operation tools such as RMB knowledge, foreign exchange knowledge, use of non-cash payment tools, credit card business, etc. To improve the financial knowledge and financial skills of financial consumers, guide consumers to establish the concept of scientific investment and financial management and responsible lending, and obtain financial services through legal channels.

Go out of the hall to publicize the residents and shops around the sub-branch, aiming at the current “cash loan”, “campus loan”, “campus loan onshore” and “routine loan” and other tricks to induce loans, the new characteristics of illegal fund-raising “Internet cross-domain”, telecom network fraud , false financial advertisements and other illegal financial activities, multi-channel, multi-level, multi-style, targeted case warnings, risk reminders and popular education. The Baidi Road Sub-branch publicized the surrounding residents and shops to fully expose its criminal methods and main characteristics to the public, remind consumers to pay attention to protecting personal financial information, and improve risk prevention awareness and ability.

3. Launch a micro-salon activity with the theme of “3.15” consumer rights protection in the hall. To customers who visit the store, we will carefully publicize the rights of financial consumers, give extensive risk reminders on hot issues of social concern, answer questions for the people present, and guide everyone to cultivate awareness of prevention and avoid illegal fundraising. Through a variety of case presentations, financial activities are comprehensively publicized to the public, avoiding blind and impulsive transactions, and enhancing self-protection capabilities. This publicity campaign has improved the public’s awareness of prevention and achieved good results.

go out and focus on teenagers

In order to further improve the financial literacy of young people and focus on young people, Baidi Road Sub-branch entered Yiyang Wensi Primary School during the “3.15” publicity cycle to carry out a variety of financial publicity and education activities.

The content of the activity course revolves around “Financial Integrity Walks with Me” to help students deepen their understanding of financial concepts and enhance their awareness of financial integrity. Through cases and short stories, they explain financial implementation such as currency and wealth management to students and help them Sort out the correct concept of money. The teaching form is rich in pictures and texts, easy to understand, and better close to the daily life of students. Students are attracted by the novel courseware and lively courses, listen carefully, and initially establish correct financial management concepts and risk prevention awareness.

In the next step, Tianjin Baidi Road Sub-branch of Minsheng Bank will continue to fulfill its social responsibilities, actively carry out normalized financial knowledge publicity activities, integrate financial knowledge into the daily life of young people, help improve the financial literacy and comprehensive level of young people, and effectively protect the legitimate rights and interests of consumers. Continue to improve people’s sense of happiness, gain and satisfaction.