Master Lu released the 2022 “Two-wheel Electric Vehicle Industry Research Report”

[ad_1]

my country’s two-wheeled electric vehicle industry has grown from scratch to a market size exceeding 100 billion yuan. It has achieved remarkable development in more than 20 years. With the enhancement of people’s awareness of environmental protection and the increasingly congested traffic conditions, electric vehicles as a To provide residents with travel means of transportation, its light, energy-saving and economical features are more and more recognized by consumers.

The continuous impact of the “New National Standard” policy has expanded the development space of traditional electric vehicle companies. The demand for stock replacement has prompted a rapid increase in the production and sales of electric vehicles, and the scale of the industry has further expanded. The driving force behind the growth is mainly driven by the demand for replacement of non-standard vehicles after the introduction of the new national standard, the normal replacement demand for qualified vehicles, and the new demand (residents, takeaways, and shared two-wheeled electric vehicles).

Under the trend of intelligentization of two-wheeled electric vehicles, the intelligent functions of the products of various manufacturers continue to iterate, promote the continuous improvement of product strength, and change the inherent perception of the relatively low-end of two-wheeled electric vehicles, thereby opening up market space and achieving both volume and price increases. Among them, the whole series of products of No. 9 Company are equipped with a number of intelligent functions as standard, which is outstanding among many manufacturers. In addition, Emma Engine MAX series, Yadea GN series, Mavericks’ multi-series products, and sodium battery two-wheelers launched by each in the future will jointly promote the enhancement of industry product power. Under the trend of stricter policies and higher product strength, industry concentration continues to increase. From 2017 to 2021, CR2 will increase from 22% to 46%. Industry leading companies will benefit from the increase in industry concentration.

Since March 2021, Master Lu has continuously released two-wheeled electric vehicle intelligent evaluation reports, accumulating more than a hundred two-wheeled electric vehicle products, involving more than 20 brands, and established and continued to improve the relevant evaluation system. In December 2021, Master Lu launched a word-of-mouth survey on two-wheeled electric vehicle users, which involved four major aspects: user attributes, brand preference, demand map, and consumption tendency. On the basis of continuing to enter the intelligent evaluation of two-wheeled electric vehicles, Master Lu released the 2022 “Two-wheeled Electric Vehicle Industry Research Report” through in-depth online and offline multi-dimensional research.

Two-wheel electric vehicle technology research and development direction

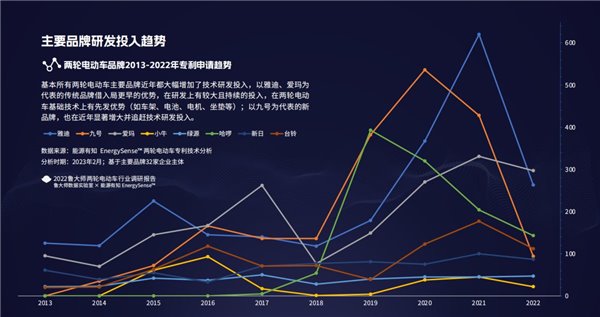

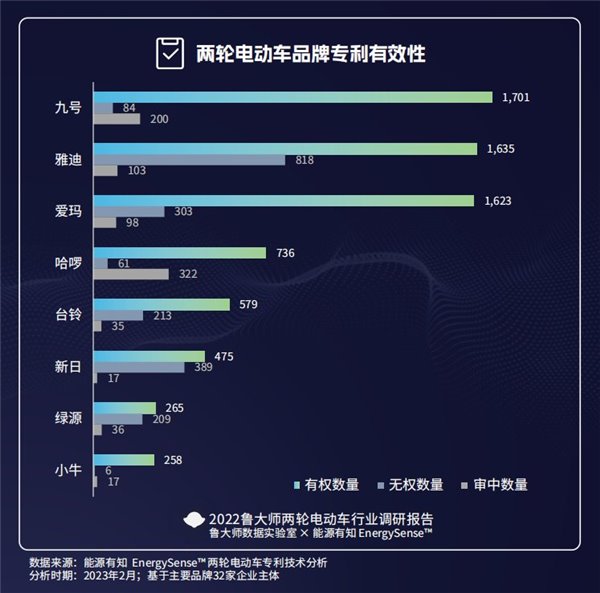

This report is based on the evaluation of the patent application data of major two-wheeled electric vehicle brands (involving 32 enterprise entities), and studies the technical reserves of each brand. Technology research and development investment trends in the field. At the same time, based on the evaluation of the recent patent application data of major two-wheeled electric vehicle brands (designing 32 enterprise entities), the current R&D investment direction/field of each brand in the field of two-wheeled electric vehicles is studied to predict the future technology application direction of each brand.

At present, the patent application trend of two-wheeled electric vehicle brands in 2013-2022 is that basically all major two-wheeled electric vehicle brands have greatly increased their investment in technology research and development in recent years, and traditional brands represented by Yadea and Emma have borrowed their earlier advantages , has a large and continuous investment in research and development, and has a first-mover advantage in the basic technology of two-wheeled electric vehicles (such as frame, battery, motor, seat cushion, etc.); Significantly increase and catch up with technology research and development investment.

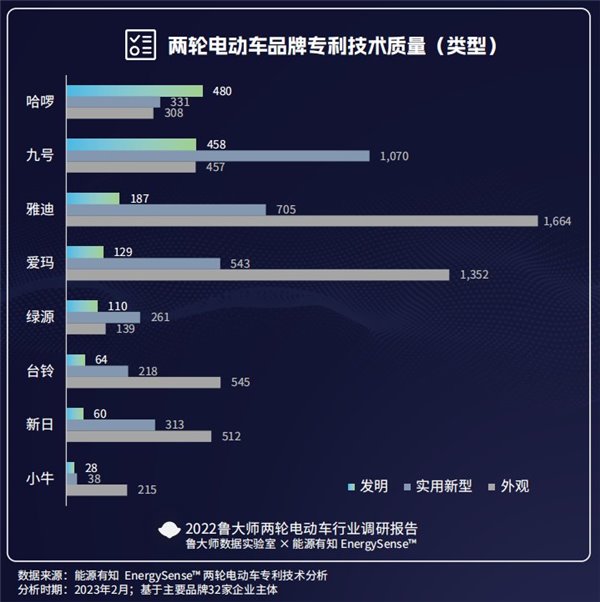

As for the quality of patent technology of major brands of electric two-wheelers, overall, invention patents account for a relatively low proportion (14.9%), and utility model patents (34.2%) and appearance patents (51.0%) dominate.

The relatively low proportion of invention patents in the two-wheeled electric vehicle industry reflects to a certain extent that the current two-wheeled electric vehicle is not a high-tech industry. Among them, Ha? and No. 9’s invention ratios (42.9%, 23.1%) are higher than the average level. As new brands in the industry, the technology is relatively “hard”. above) invest in more.

Utility model patents are patented technologies that are more practical but less valuable than inventions. Most brands in the two-wheeled electric vehicle industry have more utility model patents, reflecting that more technologies in the research and development of two-wheeled electric vehicles are based on existing technologies. Improve use.

The appearance patents of most brands in the industry account for a relatively large proportion. This part is based on the improvement of appearance. There are relatively continuous and high-frequency appearance update iterations in terms of product appearance and structure that consumers value more.

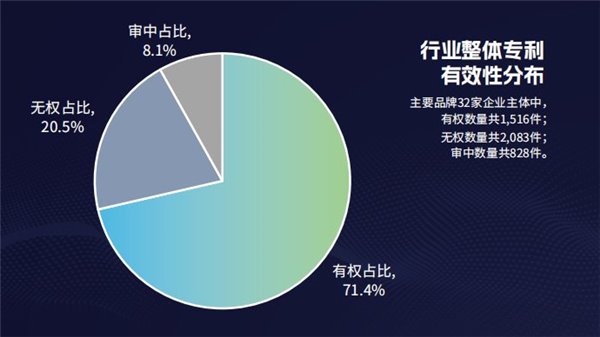

In terms of the validity of major brand patents, overall, most of the technical patents are valid (71.4%), untitled patents account for 20.5%, and another 8.1% are under review.

In the two-wheeled electric vehicle industry, although traditional brands entered the game earlier, a relatively larger proportion of patents are invalid patents, which may be because companies have discovered better alternative technologies in the process of continuous research and development, or verified corresponding technologies through actual production The cost is high/the effect is not ideal; it may also lose power naturally when the number of years expires.

These technologies that have lost their patent rights will become existing technologies and can be freely used by the public, which will benefit new brands and new players entering the industry.

Nine and Ha? have more patents under review, reflecting more R&D investment/patent applications in the near future, and subsequent authorization will further enhance competitiveness.

Two-wheel electric vehicle intelligent evaluation score

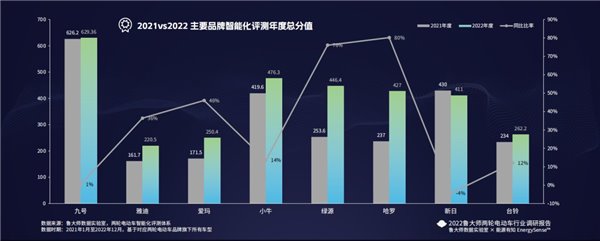

On the whole, the average level of intelligence of major brands of two-wheeled electric vehicles in 2022 will increase by about 23% compared with 2021. In 2022, the overall intelligent level of the No. 9 brand is 61% higher than the average level, and still maintains a substantial lead; while the overall intelligent level of Luyuan and Ha?

In 2022, the two-wheeled electric vehicle brands No. 9, Harmony, Mavericks, Yadea, Luyuan, Mammoth, and Xinri all have products shortlisted for the TOP 20 in intelligent evaluation.

Among them, No. 9’s products occupy half of the TOP 20, and among the TOP 10, No. 9’s products occupy 7 seats. In terms of intelligence, No. 9 has obvious advantages. Mechanic Nine MMAX 110P scored 729 in the intelligent evaluation.

There is still room for further improvement in terms of vehicle interactive transmission system, ride system, communication capability, vehicle-machine user system, etc., to bring consumers a more intelligent and practical experience.

Research on sales data of two-wheeled electric vehicles

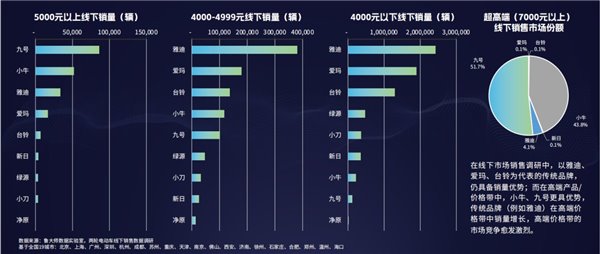

The research scope of this report includes 19 cities with the highest sales of two-wheeled electric vehicles in China: Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou, Chengdu, Suzhou, Chongqing, Tianjin, Nanjing, Foshan, Xi’an, Jinan, Xuzhou, Shijiazhuang, Hefei , Zhengzhou, Wenzhou and Haikou.

The brand part includes the main well-known and top-selling brands in the national market: Emma, No. 9, Luyuan, Tailing, Xiaodao, Mavericks, Xinri and Yadea.

The research method adopts unannounced visits and surveys, and the investigators go to electric two-wheeled specialty stores and dealerships in various cities to make unannounced visits to collect sales data. The offline unannounced visit and research time is February 2023, and the sales statistics cycle is the whole year of 2022.

In offline market sales research, traditional brands represented by Yadea, Emma, and Tailing still have sales advantages; while in high-end products/price bands, Mavericks and No. 9 have more advantages, and traditional brands (such as Yadea Di) The sales volume in the high-end price band increases, and the market competition in the high-end price band becomes increasingly fierce.

As for offline sales, overall sales in Guangzhou, Shenzhen, Beijing and Zhengzhou were high.

In terms of online sales of major two-wheeled electric vehicle brands, Ninebot has a significant sales advantage in terms of online e-commerce; especially in the TOP 10 high-end models above 5,000 yuan, Ninebot occupies 9 seats.

Finally, since March 2021, Master Lu has released more than 20 evaluation reports on the intelligentization of electric bicycles, covering electric bicycles, light electric motorcycles, and mid-to-high-end electric motorcycles. On the basis of continuing to enter the intelligent evaluation of two-wheeled electric vehicles, through online and offline multi-dimensional in-depth research, the 2022 two-wheeled electric vehicle industry research report is released. It is hoped that through data disclosure and sharing, a larger cooperation platform will be provided for the industry and manufacturers.

[ad_2]

Source link