Huami turned from profit to loss due to declining shipments, product backlog, and competition lagging behind

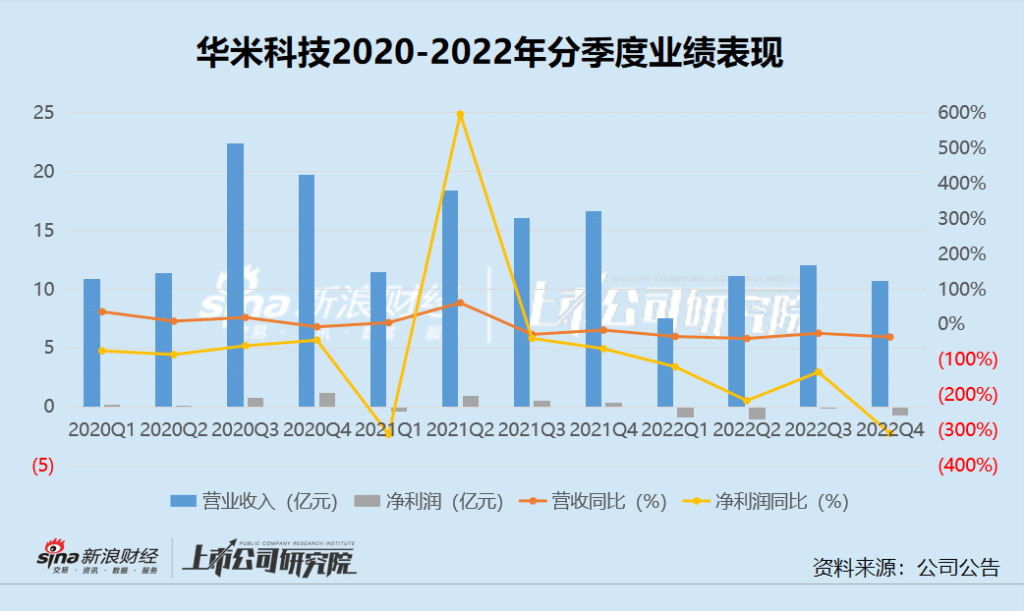

Recently, Huami Technology released its 2022Q4 and full-year financial reports. Since the fourth quarter, losses have increased again, and the entire army will be wiped out in 2022, and no quarter will be profitable.

In the fourth quarter of 2022, Huami Technology achieved revenue of 1.1 billion yuan, a year-on-year decrease of 35.5%; realized a net loss of 75.5 million yuan, a decrease of 308.04% compared to the net profit of 363 billion yuan in the same period last year. Looking at the whole year as a whole, in 2022, Huami Technology will achieve a total operating income of 4.143 billion yuan, a year-on-year decrease of 33.72%, and a net loss of 288 million yuan for the year, a year-on-year decrease of 309.22%.

Along with the reduction in revenue scale and profit turning from profit to loss, the stock price has repeatedly fallen. In 2018, when Huami Technology was listed on Nasdaq, the issue price was US$11. As the first share of Xiaomi’s ecological chain to go public in the United States, it was once glamorous. In February 2021, Huami Technology’s stock price reached an all-time high of $19.59 per share. But since then, due to the sharp drop in shipments, the gradual separation from Xiaomi, and the worsening performance, the capital market’s attitude towards Huami Technology has gradually become indifferent, and the stock price has gone downhill. As of today’s close, the share price of Huami Technology was only US$1.24 per share, which was nearly 90% lower than the issue price.

Under the premise of declining overall revenue, although the shipment volume of Xiaomi has decreased and the proportion of its own brands seems to have increased, the increasing inventory balance and increasing inventory turnover days indicate that Huami Technology’s own products may exist. There must be a backlog.

In fact, in the global market, smart watches are still on the rise, but Huami Technology’s market share is declining. In the competition with mobile phone eco-brands and professional brands, Huami Technology’s products are “more than enough than the top.” Although it has been increasing investment in research and development and marketing in recent years, it is difficult to bring positive changes to its performance.

For 6 consecutive quarters, revenue has shrunk and profitability has deteriorated. Huami Technology is gradually lagging behind the industry

From 2019 to 2022, Huami Technology achieved operating income of 5.812 billion yuan, 6.433 billion yuan, 6.250 billion yuan and 4.143 billion yuan respectively, and the year-on-year growth rates were 59.44%, 10.69%, -2.85% and -33.72%, respectively. It is difficult to maintain the high growth rate, and the revenue scale has reversed in just a few years.

From a quarterly perspective, starting from the third quarter of 2021, Huami Technology will experience a year-on-year decrease in revenue, and it will not be reversed in 2022. The revenue in 2022Q1-Q4 will decrease by 34.01%, 39.61%, 24.92% and 35.50% respectively. %; and in terms of net profit, except for the growth in the second quarter of 2021 in the past three years, all other quarters have decreased compared with the same period last year. Since 2022, net profit has turned from profit to loss, and the magnitude of the loss has also been Further deepening, respectively -119.47%, -215.53%, -134.63% and -308.04%.

The gross profit margin of Huami Technology has also reached the lowest point in recent years. From 2019 to 2022, the gross profit margin of Huami Technology will be 25.25%, 20.71%, 20.89% and 19.39% respectively, which fell below 20% last year. The net interest rate also decreased year by year, respectively 9.86%, 2.19%, -7.07% and -6.98% during the same period. While the scale of revenue is shrinking, profitability is gradually getting worse.

The most direct reason for the dismal performance is the decline in shipments of Huami Technology in recent years. From 2018 to 2022, Huami Technology’s shipments were 27.5 million units, 42.3 million units, 45.7 million units, 36.1 million units, and 20.3 million units. Since 2021, shipments have gradually decreased, down 21% year-on-year to 36.1 million units. tower. By 2022, Huami Technology’s shipments will only be 20.3 million units, a year-on-year decrease of 43.80%, which is not even comparable to the shipment scale in 2018.

But in fact, the performance of the overall market is quite different from that of Huami Technology. According to the latest data from Counterpoint Research, in 2022, global smart watch shipments will still maintain a positive growth rate of 12%, approximately 228 million. In recent years, the overall upward performance of the industry has further set off Huami Technology’s gradual fall behind. In the ranking of global smartphone market share, Huami Technology ranks 9th, with only 9% of the market share.

In 2022, the performance of China’s smart watch market will be weaker than that of the global market, with shipments falling by 9.3% year-on-year. However, in comparison, Huami Technology’s shipments, which have dropped by 43.8%, are still worse than the market performance. From the perspective of the competitive landscape, Amazfit, a subsidiary of Huami Technology, only ranked sixth, and its market share dropped from 4% in 2021 to 3%.

Source: Counterpoint Research

Behind the high inventory or the backlog of self-owned brand products, the competition is not dominant, and the investment has little effect

In the financial report, Huami Technology attributed the decrease in the company’s overall shipments to the 50.9% year-on-year decline in shipments of Xiaomi bracelets. While self-owned brand products achieved a 28.5% sequential revenue growth in the fourth quarter, contributing 77.4% of total revenue in the fourth quarter. However, Huami Technology did not specifically disclose the shipments and proportions of the Xiaomi brand and its own brand respectively. However, judging from the fact that the overall shipments and revenue have been greatly reduced, being an OEM for Xiaomi is very important for Huami. Technology still matters.

In terms of private brands, even though they have achieved a certain increase in the proportion of revenue in recent years, there are still certain problems behind them.

From the perspective of inventory, the inventory balance of Huami Technology has always been at a high level in recent years. In 2018, the inventory balance of Huami Technology was only 485 million yuan, but it soared to 894 million yuan in 2019. Since 2020, it has exceeded 100 million yuan. In recent years, inventory assets accounted for almost 20% or more. At the same time, the inventory turnover days are increasing year by year. From 2018 to 2022, they are 48.85, 57.11, 74.51, 89.80 and 122.41 days respectively. In 2022, they will reach the highest point in recent years.

Year after year of high inventory balance and slower and slower turnover rate may indicate that Huami Technology has a certain product backlog problem.

It should be noted that Huami Technology is an OEM for Xiaomi, and its shipments to Xiaomi are carried out in accordance with the orders between the two. In addition, Huami Technology’s shipments to Xiaomi have been decreasing in recent years. Long-term and large-scale inventory conditions are generally unlikely to exist. Therefore, it is reasonable to speculate that the backlog of inventory may be due to its own brand.

In the current competitive landscape of smart watches, Huami Technology’s own brand is under considerable pressure.

On the one hand, it is a mobile phone manufacturer that has a certain degree of synergy with smart watches. In addition to wearable devices, smartphones are the main channel for collection, analysis and user viewing. The synergistic bonus between mobile phones and watches, as well as consumers’ preference for mobile phone manufacturers, make mobile phone manufacturers more popular in the smart watch market. There are natural advantages. According to Counterpoint Research data, Huawei and Apple will dominate the Chinese smart watch market in 2022, with a combined share of nearly 50%. Among other brands, only OPPO, Huawei and Apple will achieve 105%, 9% and 4% respectively. increase.

On the other hand, Huami Technology is also facing competition from professional brands such as Garmin, Suntuo, and Gochi in terms of sports and health professional performance. Since the latter products tend to be richer in variety and cover more different sports scenes, they are more recognized by sports users, while Huami Technology is still slightly inferior in terms of brand awareness and professional performance, or “than the previous ones”. Insufficient, more than inferior.”

In recent years, Huami Technology has invested a lot in marketing, R&D and other aspects. From 2019 to 2022, the sales expenses of Huami Technology were 182 million yuan, 359 million yuan, 438 million yuan and 460 million yuan respectively, and the research and development expenses were 4.431 billion yuan, 538 million yuan, 515 million yuan and 517 million yuan respectively. In comparison, the increase in sales expenses is greater. But at present, Huami Technology’s investment in recent years has had little effect. The shipment volume and revenue scale are still declining, and the profit has also turned from profit to loss.

Source: Sina Finance Institute of Listed Companies