Five questions to understand the beginning and end of the bankruptcy of Silicon Valley Bank

[ad_1]

In the past dozens of hours, the collapse of the Silicon Valley Bank of the United States has swept the headlines of major media around the world. This star bank, which was once all the rage in the U.S. tech startup circle and has assets of 209 billion U.S. dollars, was taken over by the U.S. Federal Deposit Insurance Corporation (FDIC) on March 10 and declared bankrupt.

Although the U.S. government announced that it would take action to support deposits, the shock to the U.S. financial system is far from over.

Who “Killed” Silicon Valley Bank? Who is going to pay for this turmoil? Will China’s stock market be affected? Starting from a few questions, we can get a glimpse of the logic and impact of the collapse of Silicon Valley banks.

The US Federal Deposit Insurance Corporation (FDIC) announced that Silicon Valley Bank was closed by the California Department of Financial Protection and Innovation on the 10th, and the US Federal Deposit Insurance Corporation was designated as the receiver.

Why did it suddenly close down?

“Using other people’s money to invest in your own hands, you suffer losses, and encounter depositors’ debt collection’, and finally have no money to repay.” Someone vividly compared the bankruptcy process of Silicon Valley banks in this way. Generally speaking, its bankruptcy is caused by the internal cause of its own asset mismatch and external factors such as the Fed’s interest rate hike.

The story of the collapse of Silicon Valley Bank can start in 2020. At that time, the United States implemented a monetary easing policy, and Silicon Valley Bank absorbed a large amount of non-interest-bearing demand deposits from technology innovation companies in Silicon Valley and other places. In order to generate income from deposits, Silicon Valley Bank allocated a large number of long-term held-to-maturity bonds on the asset side, accounting for as high as 60% at one time.

Beginning in 2021, the United States has entered an interest rate hike cycle, causing financial institutions holding various dollar-denominated bonds such as U.S. Treasury bonds, government-backed agency bonds, and MBS to suffer a large number of floating losses. The proportion is relatively large, and the floating loss is particularly prominent.

By 2023, affected by the economic downturn and other factors, it will become difficult for some depositor companies to raise funds, and the demand for withdrawals from banks will increase, making it difficult for banks to absorb deposits. Investors and depositors attempted to withdraw $42 billion from Silicon Valley Bank on March 9 in one of the largest bank runs in the U.S. in more than a decade. Silicon Valley Bank had to sell bonds to repay principal and interest, and the bank’s profits and capital were greatly eroded.

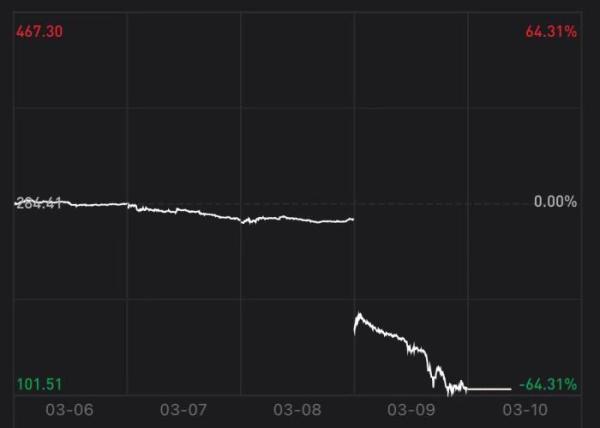

On the 9th, the stock price of Silicon Valley Bank Financial Group, the parent company of Silicon Valley Bank, plummeted by more than 60% on the 9th and 68% on the 10th, entering a trading suspension.

Silicon Valley Bank stock movement.

Who are the depositors who want to “pay the bill”?

When Silicon Valley Bank fell, the huge deposits of depositors left by the bank became a big problem.

According to the announcement issued by the FDIC, as of the end of 2022, the total deposits of Silicon Valley Bank will be about 175.4 billion US dollars. The source of these deposits, in addition to retail investors, there are many well-known large enterprises.

For example, Roku, a US streaming service provider, stated that 26% of the company’s cash reserves are deposited in Silicon Valley Bank, and most of them are not insured. Stablecoin giant Circle says $3.3 billion of its roughly $40 billion in USD Coin reserves is in Silicon Valley Bank. “Metaverse’s first stock” Roblox said that 5% of its $3 billion in cash is deposited in Silicon Valley Bank.

It is precisely because of the particularity of the depositor group of Silicon Valley Bank that the “secondary” crisis brought about by its bankruptcy has caused many concerns.

Bloomberg reported on the 12th that about 125 venture capital firms, including Sequoia Capital, signed a statement calling for limiting the impact of the bank’s collapse and avoiding possible “extinction-level events” for technology companies.

On March 12, local time, the U.S. Treasury Department, the Federal Reserve, and the FDIC issued a joint statement: From Monday, March 13, depositors can withdraw all their funds. Any losses related to the SVB bankruptcy will not be borne by taxpayers.

Will it cause the Fed to stop raising interest rates?

The Federal Reserve’s continuous interest rate hike is one of the main reasons for the collapse of Silicon Valley Bank, and the bank’s collapse has also begun to make the industry worry about whether other small and medium-sized U.S. banks that are also in the “deposit shortage” and bond floating losses can withstand the continued rise in interest rates pressure.

Lu Zhengwei, Chief Economist of Industrial Bank, said that in the future, if the Federal Reserve continues to tighten monetary policy and the growth rate of deposits continues to decline, other banks may be forced to sell bonds, which will erode profits and capital, similar to Silicon Valley Bank. “Among them, some small and medium-sized banks with relatively poor deposit stability may be more prone to risks.”

According to media reports, recently, in addition to Silicon Valley Bank, Silvergate Bank and Signature Bank in the United States have also gone bankrupt.

In this context, there are voices saying that the bankruptcy of Silicon Valley Bank may cause the Federal Reserve to slow down or stop raising interest rates.

Wang Youxin, a senior researcher at the Bank of China, told Sinonews Finance and Economics that in order to avoid a greater impact on the financial system due to crises such as runs and sell-offs caused by lack of confidence, the Fed will be more cautious in formulating policies and pay more attention to the impact on financial stability. Adjusting the pace of rate hikes will be the most likely thing to happen right now.

“At present, the probability of the Federal Reserve raising interest rates by 50 basis points at the March interest rate meeting has been greatly reduced. Given that the relevant risks are still fermenting and market sentiment is relatively fragile and sensitive, the Federal Reserve has begun to take action to create a new bank term funding plan to Qualified savings institutions provide additional funds, and do not rule out the possibility that the Federal Reserve will suspend interest rate hikes at the March interest rate meeting to better quell market panic, leave enough space and leeway for follow-up operations, and avoid excessive policy tightening. The hard landing of the economy happened.” Wang Youxin said.

Federal Reserve Chairman Powell.Photo by China News Agency reporter Sha Hanting

Will it trigger a new round of financial crisis?

After the bankruptcy of Silicon Valley Bank, US stocks quickly felt the “chill”. On March 10, the stocks of the U.S. banking industry collectively plunged. The stock prices of the four major banks of JPMorgan Chase, Bank of America, Wells Fargo and Citigroup plummeted, and the total market value evaporated by about 50 billion U.S. dollars. On the 11th, the Nasdaq index fell nearly 200 points, a drop of 1.76%; the Dow Jones index fell below the integer mark of 32,000 points, a drop of 1.07%.

The storm is also spreading to countries other than the United States. Silicon Valley Bank UK Limited will enter insolvency, the UK Treasury said. The UK government is working on financing solutions to help Silicon Valley Bank’s hundreds of UK-based clients meet their cash flow obligations. The BOK said it was closely monitoring any impact on interest rates, stock prices, exchange rates and capital flows.

Such a wide-ranging impact reminds many people of the global financial crisis triggered by the collapse of Lehman Brothers in 2008. Will the collapse of Silicon Valley Bank become the trigger for a bigger crisis?

Zhang Ming, deputy director of the Institute of Finance and Economics of the Chinese Academy of Social Sciences and deputy director of the National Finance and Development Laboratory, believes that the Silicon Valley Bank incident has had a certain negative impact on the US venture capital system and technology start-ups. Technology-based companies have had a certain impact, but judging from the new solutions of the US government, the subsequent direct impact is relatively limited.

Wang Youxin also said that considering that the Federal Deposit Insurance Corporation and the Federal Reserve have taken action and promised to fully protect all depositors and provide emergency liquidity support for the banking system, these actions will alleviate investors and depositors’ concerns about the soundness of the financial system and reduce run ons. The occurrence and spread of risks are conducive to supporting financial stability.

However, Wang Youxin also mentioned that considering that the current interest rate and liquidity environment have undergone fundamental changes, some financial institutions are exposed to increasing risks of asset-liability mismatch during the economic downturn, and the current risks have not been fully exposed, so they should be highly vigilant .

What impact will it have on Chinese companies and the stock market?

The incident also affected some Chinese companies, but it seems that the impact is limited so far. As of press time, more than 20 Chinese listed companies have released relevant news on exchanges and interactive platforms.

Among them, more than ten Hong Kong-listed companies, including Noah Holdings, Bo Medical-B, and Beihai Kangcheng-B, all issued announcements, disclosing the amount or proportion of deposits in Silicon Valley Bank, and said that the impact on the company was not significant.

In the A-share market, Joan Medical’s announcement showed that as of March 10, the deposit amount of the company and its subsidiaries in Silicon Valley Bank accounted for about 5% of the company’s total cash assets and financial assets. In addition, many companies urgently clarified that they did not deposit in Silicon Valley Bank. Hong Kong-listed companies such as Beikang Medical-B, Akeso Bio-B, and Ascletis Pharmaceutical-B announced that they had never had business cooperation with Silicon Valley Bank, or held no bank accounts or deposits.

Yang Delong, chief economist of Qianhai Open Source Fund, judged, “The current impact of the collapse of Silicon Valley Bank has not been transmitted to the A-share market. Everyone can wait and see the changes without worrying too much.”

Zhang Ming also analyzed that from the current point of view, the impact of the Silicon Valley Bank incident on China’s financial market is very limited. But for China’s sovereign and private investors, the Silicon Valley Bank incident reminded them once again of the market risks that large-scale investment in US financial assets may face.

“It is still a top priority for Chinese investors to realize asset diversification at a lower cost in various ways.” Zhang Ming mentioned.

[ad_2]

Source link