“Financial running water” waters the development of the real economy

[ad_1]

Finance is the blood of the real economy. Since the beginning of this year, in line with the implementation of the “Ten Actions” of the Municipal Party Committee and the Municipal Party Committee and the “3+1+1” work ideas of the District Party Committee, China Merchants Bank has based itself on regional development, through product innovation, targeted assistance, technological empowerment, and government-bank linkage. The measures and work are integrated into the general trend of Wuqing’s regional economic recovery, which will help the overall recovery of the regional consumer market to get off to a good start.

Product Innovation

Let enterprises no longer wait for “loans”

“I didn’t expect the loan to come down so soon!” said the financial director of a small giant company specializing in special new products at the newly opened Wuqing Yongyang branch of China Merchants Bank. “Now that the company is in the stage of scale expansion, this loan comes really So timely.”

In recent years, China Merchants Bank has stepped up support for the financing needs of small and micro enterprises, created new inclusive loan products and new models, and differentiated designed products to provide credit support for enterprises, and continuously increased the proportion of first-time loans and credit loans. For enterprises that have obtained government evaluation qualifications such as “Young Eagle”, “Gazelle”, and “Specialized Special New Loan”, special scorecard credit products such as “Young Eagle Loan”, “Gazelle Loan” and “Specialized Special New Loan” have been launched . In view of the actual situation of some technology-based enterprises with light asset operations and no suitable collateral, by comprehensively considering the company’s operating conditions and future development, it provides specialized and special new credit loans. At the same time, it also provides enterprises with a full range of financial services to help them Enterprises quickly raise funds to open up markets and continue to grow. As of the end of March this year, the balance of inclusive small and micro enterprise loans was nearly 300 million yuan, an increase of 71% over the same period last year; a total of 106 small and micro enterprises have been benefited, an increase of 55% over the same period last year.

Precision Drip Irrigation

Helping enterprises to bail out and solve problems

Small and micro enterprises have a large volume and a wide range, and are the “capillaries” and important pillars of the national economy. Through “precision drip irrigation”, support small and micro enterprises, and contribute financial power to the high-quality economic and social development of Wuqing District.

In order to rescue the consumer market affected by the epidemic, China Merchants Bank actively responded to national policies, insisted on “blood transfusion” and “lower pressure” simultaneously, and actively met the financing needs of enterprises severely affected by the epidemic in industries such as accommodation, catering, tourism, retail, and logistics , design a financing plan of “one household, one policy”, and provide corporate financing support from various aspects such as fee reduction, deferred repayment of principal and interest, loan pricing subsidies, etc. The franchisee finally breathed a sigh of relief.

“Last year, the business of the catering service industry decreased, but the cost of manpower and rent was still there, and there was a lot of pressure on the operation. Fortunately, the bank notified that the loan repayment could be postponed, which was just in time.” Affected by the epidemic, Juewei Duck Neck franchisees operated Difficulties in collecting money from stores have affected cash flow. After understanding the actual situation, China Merchants Bank handled loans under the small and micro mortgage line of credit for customers to borrow new ones and repay old ones, effectively reducing the pressure on customers to repay when due. At the beginning of this year, facing the hot spring breeze of the consumer market, Juewei duck neck has continued to grow and develop in the catering market. Recently, it is considering opening several more branches to expand its business.

technology empowerment

Build a new ecology of high-quality services

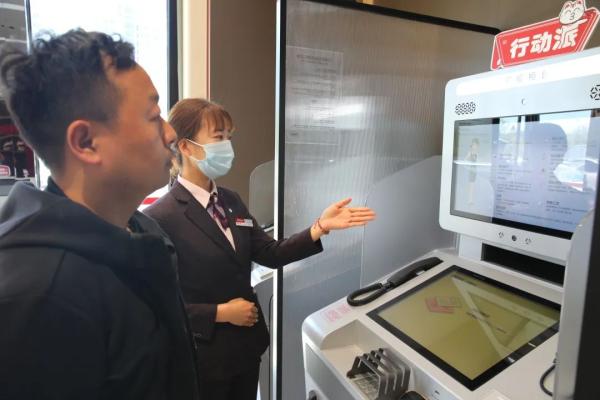

“To serve enterprises, the first thing banks need to do is to reduce the financing costs of enterprises. At the same time, in order to further optimize the process, transfer financial services to online.” The relevant person in charge of the newly opened Wuqing Yongyang Sub-branch of China Merchants Bank said, “In order to’ Let customers run less and make service self-service’, we have created a new 3.0plus boutique outlet based on the concept of ‘technology + life + finance’, using technology to intelligently link personnel, machines and furniture to complement each other’s advantages, thus forming a ‘network + The online and offline service model of China Merchants Bank App + Scenario has greatly saved customers’ round trips, queuing, and waiting time, and strived to achieve a “one-stop” service, creating a “convenience business card” for China Merchants Bank in Wuqing.”

The ability of financial institutions to effectively serve the needs of real enterprises and the people is also inseparable from the service empowerment of local governments for financial institutions. As the financial supervision department of the local government, the Financial Bureau plays a very important role in supporting the development of the financial industry. Whether it is policy support or business-guided development, such as innovative financial services, serving the real economy, etc., or the connection between banks and enterprises, and the location selection of institutions, etc., they all reflect the responsibility of government departments to stand at the forefront, be efficient and convenient for the people, and create a good business environment. as.

Rural revitalization, finance first. In recent years, the region has given full play to the role of financial support for rural revitalization, promoted the innovation of financial products and financial models, and provided strong support for building a model for rural revitalization in Wuqing. China Merchants Bank focuses on key projects to make up for shortcomings in the agricultural and rural areas, gives full play to its own advantages and operating characteristics, and continuously intensifies innovations in “product creation, service expansion, and preferential support” to help rural areas during the critical period when rural revitalization is on the fast track. Develop and prosper, increase production and income for farmers.

Government-Bank Linkage

Consolidate the new joint forces of government and finance

Since 2020, China Merchants Bank has provided full-process government special bond services for the whole region. As of the end of February this year, 11 projects have been issued, with a cumulative issuance amount of 14.167 billion yuan; 15 reserve projects, the total demand for bonds is expected to exceed 22.52 billion yuan. Especially in the field of serving agricultural and rural development, it has successively contributed to the regional water system connection project, water engineering, farmland water conservancy transformation and upgrading and characteristic agricultural projects, rural drinking water quality and efficiency improvement projects – Dongmaquan Second Water Distribution Plant, Dahuangbao Wetland Natural A total of 11.287 billion yuan of special bonds have been issued for projects such as the rectification and restoration of protected areas, and cultural tourism projects in Gaocun towns. The agriculture-related fields in Wuqing District that are currently being assisted, such as the under-forest economy, the vegetable basket project in Daliang Town, and the rural revitalization project in Gaocun Town, have a cumulative financing demand of nearly 15 billion yuan.

In the near future, Wuqing’s financial industry will continue to take the initiative and take responsibility, give full play to the advantages of financial technology, empower customers, empower industries, empower economic and social development, research and develop and innovate various precisely matching products and guarantee measures, and further strengthen the financial industry The pertinence of the products allows the financial “living water” to flow into the heart of the enterprise, and helps the “service” of the enterprise to truly warm up to the economic entity.

[ad_2]

Source link