Chengdu Huiyang Investment: The prosperity of the titanium metal industry has reached a low point, waiting for the recovery of downstream demand

[ad_1]

Titanium dioxide, a pseudonym titanium dioxide, has the advantages of high refractive index, ideal particle size distribution, good hiding power and tinting power, and is widely used in coatings, rubber, plastics, papermaking, printing inks, daily chemicals, electronics industry, micro-electromechanical and environmental protection industries .

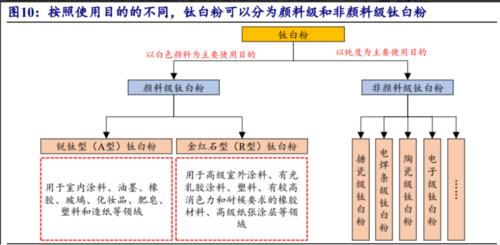

According to the purpose of use, titanium dioxide can be divided into pigment grade (white pigment as the main purpose of use) and non-pigment grade (purity as the main purpose of use) titanium dioxide. Among them, according to the crystal form, pigment-grade titanium dioxide is divided into two types: anatase titanium dioxide (abbreviated as type A) and rutile titanium dioxide (abbreviated as R type); anatase titanium dioxide is mainly used in indoor coatings, inks, rubbers, etc. , glass, cosmetics, soap, plastic and paper making and other fields; rutile titanium dioxide has better weather resistance and hiding power than anatase titanium dioxide, and is mainly used for high-grade outdoor coatings, glossy latex coatings, plastics, etc. Rubber materials, high-grade paper coatings and other fields that require color reduction and weather resistance. In addition, according to the purpose of use, non-pigment grade titanium dioxide can also be divided into enamel grade titanium dioxide, welding rod grade titanium dioxide, ceramic grade titanium dioxide, electronic grade titanium dioxide and other types. According to the data from China Chemical Industry News, the domestic output of titanium dioxide in 2021 will be 3.79 million tons, of which rutile products account for 82.5%, anatase products account for 13.0%, and non-pigment grade and other types of products account for 4.5%.

Resource side: Domestic titanium ore resources are abundant, but high-grade titanium ore still relies on imports

Titanium is one of the most widely distributed and abundant elements in the earth’s crust, accounting for 0.61% of the weight of the earth’s crust, ranking ninth. Titanium has strong chemical activity. There is no elemental titanium in nature, and it is easy to combine with oxygen. Titanium in minerals mainly exists in the form of TiO2 and titanate, and often coexists with iron to form various minerals. Minerals with a TiO2 content of more than 1% alone are More than 140 species, of which only more than 10 species have industrial value, mainly rutile, ilmenite, titanomagnetite, anatase, white titanium, perovskite and so on.

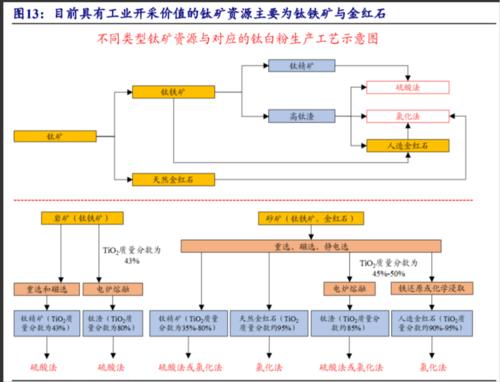

However, because the economic value and mining potential of titanium resources are highly dependent on the quality of the minerals, currently the titanium resources with industrial mining value are mainly ilmenite and rutile.

in:

(1) Ilmenite: Ilmenite is divided into rock ore and placer. The TiO2 grade in the titanium concentrate selected from the rock ore is generally 42%-48%, while the titanium concentrate selected from the placer is generally 42%-48%. TiO2 grade can exceed 50%. Ilmenite is currently the most important titanium ore resource, which can be directly used as the raw material of sulfuric acid titanium dioxide, but this process will produce a large amount of ferrous sulfate, causing greater environmental pressure and wasting a large amount of iron resources. In order to make full use of the iron in ilmenite, many smelters use ilmenite as raw material for electric furnace smelting to obtain pig iron and high-titanium slag, and then the high-titanium slag is used as raw material for the production of titanium dioxide by sulfuric acid or chlorination.

(2) Rutile: Rutile is one of the most widely distributed placer minerals in titanium ore, with high grade, TiO2 content is generally higher than 2%, and contains Fe, Mg, Al, Si, Ca and other impurity elements. After beneficiation, magnetic separation, flotation, electric separation and acid leaching, high-grade concentrates with a TiO2 content of 95%-99% can be obtained, which can then be used to produce titanium dioxide, titanium sponge, titanium tetrachloride and other products . Although rutile resources are relatively high-quality, natural rutile reserves are relatively small and it is difficult to meet production needs. Therefore, artificial rutile (also called synthetic rutile) needs to be produced in large quantities as a substitute. At present, mainstream manufacturers mostly use ilmenite or high-titanium slag as raw materials, and use methods such as sulfuric acid leaching, hydrochloric acid leaching, selective chlorination, and reduction corrosion to produce artificial rutile.

Global titanium resources are dominated by ilmenite, concentrated in China, Australia, India and other countries. According to USGS data, as of 2021, the global reserves of titanium ore resources total about 749 million tons (calculated as TiO2), of which the reserves of ilmenite and rutile resources are 700 million tons and 49 million tons respectively, accounting for 93.41% and 6.59% respectively. In terms of regions, global titanium ore resources are mainly distributed in China, Australia, India and other countries. Among them, China has the most abundant titanium ore resources, with a total reserve of 230 million tons, accounting for 30.7%.

From the perspective of titanium ore production, global titanium ore production in 2021 will mainly come from China, South Africa and Mozambique. According to USGS data, the total global titanium ore output (calculated as TiO2) in 2021 will total 9.04 million tons, of which China, South Africa, and Mozambique will respectively reach 3 million tons, 1.09 million tons, and 979,000 tons, accounting for 33.2%, 12.1%, and 10.8%. In addition, as an important supplement other than ilmenite and rutile, according to the “2021 China Titanium Industry Development Report” data, the total output of global titanium-rich materials (including titanium slag and artificial rutile) will reach 1.31 million tons (calculated as TiO2) in 2021 , of which South Africa, Canada, Australia and Norway accounted for 30%, 45%, 13% and 12% respectively.

Supply: pay attention to the progress of the clearance of backward production capacity of small and medium-sized enterprises and the progress of new production capacity

my country is the main producer of titanium dioxide in the world, and the production capacity of titanium dioxide accounts for half of the world

Domestic titanium dioxide production capacity accounts for half of the world. According to the announcement data of Baichuan Yingfu and CNNC Titanium Dioxide Company, domestic titanium dioxide production capacity has gradually increased since 2017, and its production capacity accounts for an overall upward trend in the global proportion. As of 2021, the total domestic titanium dioxide production capacity will reach 4.59 million tons, accounting for 53.9% of the global titanium dioxide production capacity. Overseas titanium dioxide production capacity is mainly concentrated in the United States and Germany. According to USGS data, in terms of regional distribution of global titanium dioxide production capacity in 2021, in addition to China, the United States and Germany rank the top two in terms of production capacity, accounting for 16% and 6% of the global titanium dioxide production capacity respectively. In addition, the production capacity of titanium dioxide in the United Kingdom, Japan, Mexico, Australia and other countries is also relatively high.

Domestic titanium dioxide production is dominated by small and medium-sized enterprises, and there is still room for further improvement in industry concentration

The concentration of domestic titanium dioxide industry is low, and the production capacity CR6 is 49%. According to Baichuan Yingfu data, as of November 2022, the top six domestic titanium dioxide production capacity are Longbai Group, CNNC Titanium Dioxide, Shandong Dongjia Group, Jinhai Titanium Industry, Nanjing Titanium Dioxide and Yuxing Chemical, with a total production capacity of 238 10,000 tons/year, the production capacity of CR6 is 49%.

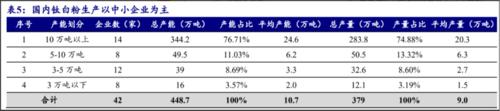

Domestic titanium dioxide production is dominated by small and medium-sized enterprises, and the industry concentration is expected to further increase in the future. According to the “2021 Economic Operation Analysis and Future Development of China’s Titanium Dioxide Industry” published by Chen Gang et al. (2022), as of 2021, there are a total of 42 full-process production enterprises with normal production conditions in the domestic titanium dioxide industry, with a total production capacity of 4.487 million tons/year. Among them, most of the production enterprises are small and medium-sized enterprises, and the number of enterprises with a titanium dioxide production capacity of less than 100,000 tons per year has reached 28, accounting for 66.67%. Looking forward to the future, we believe that with the gradual clearing of the backward production capacity of small and medium-sized enterprises in the industry, the concentration of the domestic titanium dioxide industry is expected to further increase.

Demand: The macroeconomic recovery resonates with the marginal improvement of real estate, and the demand for titanium dioxide may bottom out

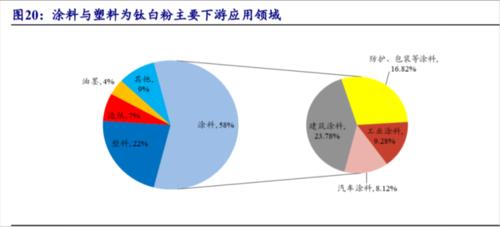

The coating and plastic industries are the main downstream application fields of titanium dioxide. According to the company’s 2021 annual report, in the global consumption structure of titanium dioxide products, coatings and plastics are the top two sources of demand, accounting for 58% and 22% respectively. Among them, in terms of coatings, architectural coatings are the largest application field, accounting for 23.78% of the total demand for titanium dioxide.

Downstream demand is weak, and the titanium dioxide industry is now at a low point. From 2017 to 2021, the apparent domestic consumption of titanium dioxide will rise steadily, with annual consumption gradually increasing from 2.26 million tons to 2.56 million tons, with an average annual compound growth rate of 3.13%. Since 2022, affected by the slowdown in macroeconomic growth and the downturn in the real estate industry, domestic downstream demand for titanium dioxide has been sluggish. The apparent consumption from January to November was 2.05 million tons, a year-on-year decrease of 13.4%.

The Central Economic Work Conference set the tone for steady growth of the domestic economy in 2023. According to Xinhua News Agency, on December 14, the State Council issued the “Strategic Planning Outline for Expanding Domestic Demand (2022-2035)” and issued a notice requiring all regions and departments to implement it in light of their actual conditions. The Outline proposes that firmly implementing the strategy of expanding domestic demand and cultivating a complete domestic demand system is an inevitable choice to accelerate the establishment of a new development pattern with the domestic cycle as the main body and domestic and international dual cycles mutually reinforcing, and is a strategic decision to promote my country’s long-term development and long-term stability.

At the same time, according to CCTV news, the Central Economic Work Conference will be held in Beijing from December 15th to 16th. We will strengthen the regulation and control of macro-macro policies, strengthen the coordination and cooperation of various policies, and form a joint force to promote high-quality development. Looking forward to the future, we believe that with the gradual optimization of epidemic prevention and control policies and the continued efforts to stabilize growth policies, the domestic macro economy is expected to usher in recovery, and downstream demand for titanium dioxide is expected to gradually pick up.

Export: Overseas titanium dioxide production capacity has shrunk, and domestic titanium dioxide export volume has continued to grow

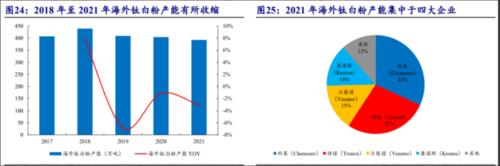

The cost of overseas titanium dioxide is under pressure, and the overall production capacity has shrunk. Compared with domestic ones, the costs of raw materials, energy and power, and labor of overseas titanium dioxide production enterprises are at a higher level, and they are also facing stricter environmental protection supervision policies. In this context, the overall production capacity of overseas titanium dioxide has shrunk in recent years. For example, Connors expects to shut down the 35,000 tons of sulfuric acid titanium dioxide production line at the Leverkusen plant in Germany in early 2021. At the same time, according to SMM news, with the continuous fermentation of the energy crisis since 2022, various local chemical products in Europe are facing production reduction and suspension, and the production capacity of the titanium dioxide industry has dropped to 20% of the total load at least.

Supply: Domestic production of titanium sponge has grown steadily, but some high-end products still rely on imports

China is the largest producer of titanium sponge in the world, accounting for about 60% of the output in 2021

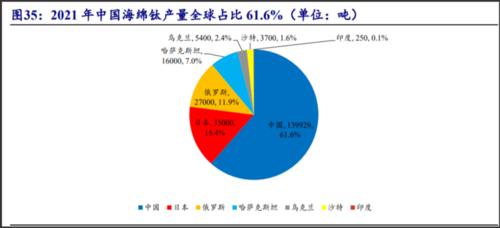

In 2021, the global output of titanium sponge will be 227,300 tons, and China will account for about 60%. According to the “2021 China Titanium Industry Development Report”, the global output of titanium sponge in 2021 will total 227,300 tons, a year-on-year increase of 0.5%. Among them, China, Japan, and Russia are the top three producers, with output of 139,900 tons and 35,000 tons respectively. tons and 27,000 tons, accounting for 61.6%, 15.4%, and 11.9% respectively.

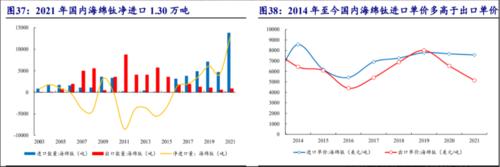

Domestic sponge titanium still relies on imports for some high-end products, and the net import volume in 2021 will be 13,000 tons. Although domestic sponge titanium production is growing steadily, the quality of sponge titanium is still lacking. The product structure is low-end, and some high-end titanium sponges still rely on import. According to Wind data, in 2021, domestic titanium sponge imports will be 13,835 tons, exports will be 841 tons, and net imports will be 12,994 tons. At the same time, from the perspective of import and export unit prices, the import unit price of domestic titanium sponge has been higher than the export unit price since 2014. As of 2021, the import and export unit prices are 7568 US dollars / ton and 5138 US dollars / ton respectively.

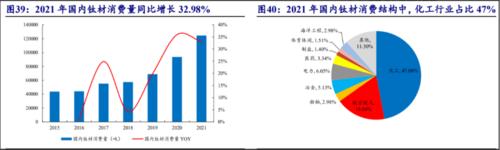

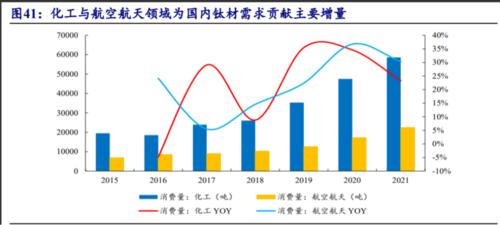

From the perspective of domestic titanium consumption structure, the chemical industry is the largest source of demand, accounting for 47.08% in 2021. According to the “2021 China Titanium Industry Development Report” data, in the domestic titanium consumption structure in 2021, chemical industry and aerospace are the top two application fields, with consumption reaching 58,600 tons and 24,500 tons respectively, accounting for 47.08%, 24,500 tons, respectively. 18.04%.

The chemical and aerospace industries are booming, contributing to the main increase in domestic titanium demand

In terms of fields, the fields of chemical industry and aerospace contribute to the main increase in domestic demand for titanium materials. According to the “China Titanium Industry Development Report” from 2015 to 2021, from 2015 to 2021, the consumption of titanium materials in the domestic chemical and aerospace fields will gradually increase from 19,500 tons and 6,900 tons to 59,600 tons and 24,500 tons respectively, with an average annual compound growth rate. The speed reached 20.14% and 21.84% respectively, both of which contributed to the main increase in domestic titanium demand.

In aviation, titanium is one of the main materials for aircraft structures and engines. Among them, titanium is mainly used for fan blades, compressor blades, discs, shafts and casings on engines, and in aircraft structures, it is mainly used for skeletons, skins, fuselage frames, landing gear, firewalls, wings, Empennage, longitudinal beams, hatch covers, doublers, keels, snap brakes, parking gear, fasteners, front wheels, arch frames, flap slides, doubler panels, traffic lights and signal panels, etc. In the field of aviation, the application of titanium has many advantages: (1) reduce structural weight and improve structural efficiency; (2) superior high temperature resistance; (3) meet the requirements of matching with composite materials; (4) meet the requirements of high corrosion resistance and long-life requirements.

Supply and demand docking: demand drives growth, and the future is promising

Titanium has many superior properties such as low density, high specific strength, low thermal conductivity, good high temperature and low temperature resistance, strong corrosion resistance, good biocompatibility, etc., and has a wide range of applications. From 2015 to 2021, domestic titanium consumption will continue to increase from 43,700 tons to 124,500 tons, with an average annual compound growth rate of 19.05%. Among them, the domestic consumption of titanium materials in 2020-2021 will reach 93,600 tons and 124,500 tons respectively, a year-on-year increase of 35.94% and 32.98% respectively. In the future, with the accelerated release of terminal demand represented by chemical industry and aerospace, the upstream sponge titanium industry may fully benefit.

[ad_2]

Source link